Page 60 - 25148.pdf

P. 60

48 • The 100 Greatest Ideas for Building the Business of Your Dreams

There is a huge benefit to be gained if a division or a company can increase its

sales volumes without increasing its fixed costs. It illustrates what managers are

often talking about. 'We have to sweat the assets.' When you have spent money on

infrastructure of any sort, slight increases in sales have an unexpectedly high impact

on the bottom line.

The concept of operating leverage shows the benefit of this.

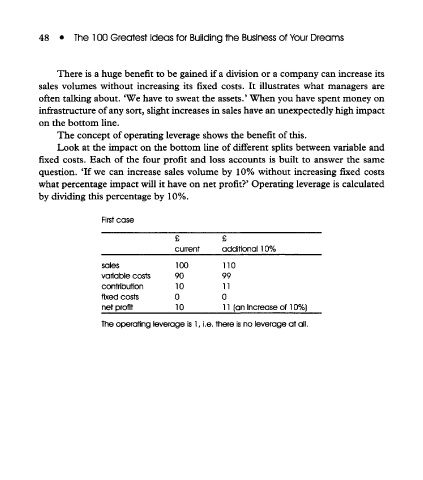

Look at the impact on the bottom line of different splits between variable and

fixed costs. Each of the four profit and loss accounts is built to answer the same

question. 'If we can increase sales volume by 10% without increasing fixed costs

what percentage impact will it have on net profit?' Operating leverage is calculated

by dividing this percentage by 10%.

First case

£ £

current additional 1 0%

sales 100 110

variable costs 90 99

contribution 10 11

fixed costs 0 0

net profit 10 1 1 (an increase of 10%)

The operating leverage is 1, i.e. there is no leverage at all.