Page 8 - The Tech Teke

P. 8

Beta-Pi Needs Your Help – Here is how!

Leave A Legacy

Tau Kappa Epsilon’s “next-generation” facility is becoming a reality! Ways to include the House Corporation:

The “leave a legacy” opportunity encourages alumni to give back to

an experience that helped shape their lives. It is an opportunity to a. Through your WILL or TRUST

ensure that the same experiences and opportunities are available for b. By designating as a beneficiary on a life insurance policy

future generations of young men at Georgia Tech. c. By designating as a beneficiary on an IRA or retirement account

d. Other (speak with your financial advisors)

For many of us it is often easier to contemplate a significant charitable

gift through our estates once we know that our needs for care and SAMPLE language you or your advisor might find useful: “I leave

expenses have been met. Often alumni consider bequests to their the sum of $XXX to the Beta-Pi House Corporation of Tau Kappa

church, school and other organizations that are important in their Epsilon Fraternity at Georgia Tech.” We recommend that you include

lives. Too often, many don’t pause to think they could also include instructions that the gift is made in care of Tau Kappa Epsilon, 7439

Teke. Woodland Dr., Indianapolis, IN 46278.

YOU CAN HELP! Upon completion of both construction Phases, *For questions or to discuss ways you can plan for the future of

the Beta-Pi House Corporation will be responsible for a significant Beta-Pi, please contact David Adcock, President of the Tau Kappa

mortgage. In addition, the house will inevitably need work completed Epsilon Beta-Pi Chapter Corporation, Inc. at (404) 771-8831 or

in the future. dadcock007@gmail.com, or John Reagan, Chairman of Tau Kappa

Epsilon of Georgia, Inc. at (678) 773-4025 or john@reaganco.net.

By including the Beta-Pi House Corporation in your estate plans,

you can help to ensure that future generations of Tekes will benefit. **Information contained herein is not intended to serve as legal or

A gift through your estate is truly a LEGACY through which you can tax advice. You should consult your own advisors to discuss your

secure the future of TKE at Georgia Tech. particular financial situation.

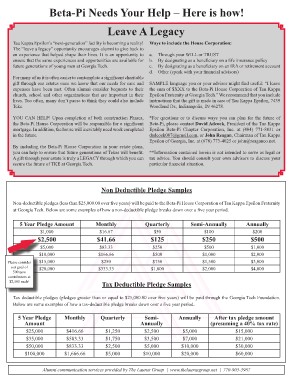

Non Deductible Pledge Samples

Non-deductible pledges (less than $25,000.00 over five years) will be paid to the Beta-Pi House Corporation of Tau Kappa Epsilon Fraternity

at Georgia Tech. Below are some examples of how a non-deductible pledge breaks down over a five year period.

5 Year Pledge Amount Monthly Quarterly Semi-Annually Annually

$1,000 $16.67 $50 $100 $200

$2,500 $41.66 $125 $250 $500

$5,000 $83.33 $250 $500 $1,000

$166.66 $500 $1,000 $2,000

$10,000 $750 $1,500 $3,000

$250 $1,000 $2,000 $4,000

Please consider $15,000 $333.33

our goal of $20,000

500 new

Tax Deductible Pledge Samples

contributors at

$2,500 each!

Tax deductible pledges (pledges greater than or equal to $25,000.00 over five years) will be paid through the Georgia Tech Foundation.

Below are some examples of how a tax-deductible pledge breaks down over a five year period.

5 Year Pledge Monthly Quarterly Semi- Annually After tax pledge amount

Amount Annually (presuming a 40% tax rate)

$25,000 $416.66 $1,250 $5,000

$35,000 $583.33 $1,750 $2,500 $7,000 $15,000

$50,000 $833.33 $2,500 $3,500 $10,000 $21,000

$100,000 $1,666.66 $5,000 $5,000 $20,000 $30,000

$10,000 $60,000

Alumni communication services provided by The Laurus Group | www.thelaurusgroup.net | 770-903-3987