Page 25 - Farm and Food Policy Strategies for 2040 Series

P. 25

“many hurdles to go into organic” – such as having to increase his bin storage from about

100,000 bushels up to 250,000. Also, he says, “You don’t get paid near as quickly… Where in

conventional ag, you can deliver to the local elevator and get a check the same day . . . In the

organic world, it seems to be spread out over time, so there is a lot more management that’s

involved in the organic world.”

Beside organics’ extra record-keeping

requirements, Raile says, “from the

standpoint of growing crops, that wasn’t a

difficult transition at all.” That’s because

after his 38 years in farming, he’s

returning to the low-input, high-

management practices he used in his early

years. He acknowledges, however, that for

newcomers or for conventional farmers

who’ve always depended on glyphosate

and other chemical quick fixes from local

input suppliers, they may have a steeper

learning curve.

Like Illinois farmer Allen Williams, Raile

is confident organics will continue to

thrive in 2040 but that “organic and

conventional can all work together.” He

adds that organics’ growth will benefit

conventional producers.

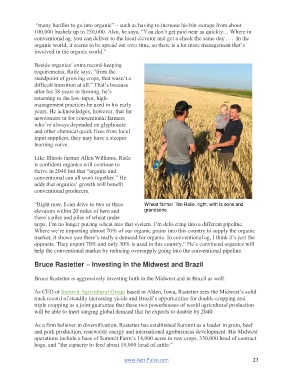

“Right now, I can drive to two or three Wheat farmer Tim Raile, right, with is sons and

elevators within 20 miles of here and grandsons

there’s piles and piles of wheat under

tarps. I’m no longer putting wheat into that system. I’m delivering into a different pipeline.

Where we’re importing almost 70% of our organic grains into this country to supply the organic

market, it shows you there’s really a demand for organic. In conventional ag, I think it’s just the

opposite. They export 70% and only 30% is used in this country.” He’s convinced organics will

help the conventional market by reducing oversupply going into the conventional pipeline.

Bruce Rastetter – Investing in the Midwest and Brazil

Bruce Rastetter is aggressively investing both in the Midwest and in Brazil as well.

As CEO of Summit Agricultural Group based in Alden, Iowa, Rastetter sees the Midwest’s solid

track record of steadily increasing yields and Brazil’s opportunities for double cropping and

triple cropping as a joint guarantee that these two powerhouses of world agricultural production

will be able to meet surging global demand that he expects to double by 2040.

As a firm believer in diversification, Rastetter has established Summit as a leader in grain, beef

and pork production, renewable energy and international agribusiness development. His Midwest

operations include a base of Summit Farm’s 14,000 acres in row crops, 350,000 head of contract

hogs, and “the capacity to feed about 10,000 head of cattle.”

www.Agri-Pulse.com 23