Page 7 - Farm and Food Policy Strategies for 2040 Series

P. 7

farmland consider family legacy a top reason to keep their land, and such clients tend to be large

landowners, he said.

In similar fashion, Iowa State University’s extensive Iowa Farmland Ownership and Tenure

Survey 1982-2017, recently released, says 29% of all Iowa landowners say that “family or

sentimental reasons,” is “very important” to their land ownership – compared with 22% in ISU’s

2012 survey.

Besides the inclination to retain farmland, Congress has robustly expanded the incentives

to do so by way of changes in federal estate and gift taxes.

Jerry Cosgrove, adviser for AFT’s Farm Legacy Program, explains that, since Congress acted,

“if you hold onto (farm assets) until you die, the basis (for capital gain tax) will be stepped up

and there will be zero capital gains tax. And, as a practical matter, there is no estate tax now

unless you’re very wealthy. The federal estate tax exclusions combined (for a married couple)

are now more than $22 million.”

“There is really a strong disincentive now to transfer any appreciated asset, including

farmland, during your lifetime, either by gift or by selling it,” Cosgrove said.

Source: Iowa State University Extension

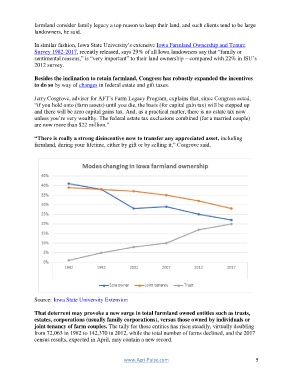

That deterrent may provoke a new surge in total farmland owned entities such as trusts,

estates, corporations (usually family corporations), versus those owned by individuals or

joint tenancy of farm couples. The tally for those entities has risen steadily, virtually doubling

from 72,063 in 1982 to 142,370 in 2012, while the total number of farms declined, and the 2017

census results, expected in April, may contain a new record.

www.Agri-Pulse.com 5