Page 10 - Export or Bust eBook

P. 10

Exporters are also aiming American soymeal at aquaculture in those regions, said Jim Sutter, chief

executive of the U.S. Soybean Export Council. “Aquaculture is the most rapidly growing consumer

protein (industry),” Sutter said. “There is more farmed fish raised worldwide than there is beef

production.”

The biggest target, he said, is China, “the single largest aquaculture producer ... (with) about half

the aquaculture in the world.” Already, 15-20 percent of China’s soybean imports are used as

soymeal in fish farms, he said.

Protein sells

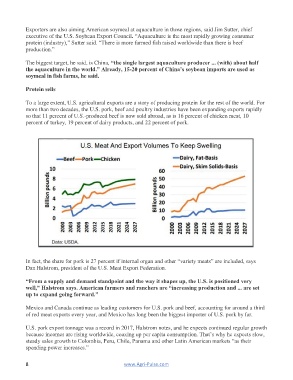

To a large extent, U.S. agricultural exports are a story of producing protein for the rest of the world. For

more than two decades, the U.S. pork, beef and poultry industries have been expanding exports rapidly

so that 11 percent of U.S.-produced beef is now sold abroad, as is 16 percent of chicken meat, 10

percent of turkey, 19 percent of dairy products, and 22 percent of pork.

In fact, the share for pork is 27 percent if internal organ and other “variety meats” are included, says

Dan Halstrom, president of the U.S. Meat Export Federation.

“From a supply and demand standpoint and the way it shapes up, the U.S. is positioned very

well,” Halstrom says. American farmers and ranchers are “increasing production and ... are set

up to expand going forward.”

Mexico and Canada continue as leading customers for U.S. pork and beef, accounting for around a third

of red meat exports every year, and Mexico has long been the biggest importer of U.S. pork by far.

U.S. pork export tonnage was a record in 2017, Halstrom notes, and he expects continued regular growth

because incomes are rising worldwide, coaxing up per capita consumption. That’s why he expects slow,

steady sales growth to Colombia, Peru, Chile, Panama and other Latin American markets “as their

spending power increases.”

8 www.Agri-Pulse.com