Page 9 - Export or Bust eBook

P. 9

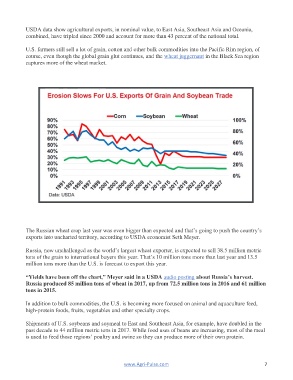

USDA data show agricultural exports, in nominal value, to East Asia, Southeast Asia and Oceania,

combined, have tripled since 2000 and account for more than 43 percent of the national total.

U.S. farmers still sell a lot of grain, cotton and other bulk commodities into the Pacific Rim region, of

course, even though the global grain glut continues, and the wheat juggernaut in the Black Sea region

captures more of the wheat market.

The Russian wheat crop last year was even bigger than expected and that’s going to push the country’s

exports into uncharted territory, according to USDA economist Seth Meyer.

Russia, now unchallenged as the world’s largest wheat exporter, is expected to sell 38.5 million metric

tons of the grain to international buyers this year. That’s 10 million tons more than last year and 13.5

million tons more than the U.S. is forecast to export this year.

“Yields have been off the chart,” Meyer said in a USDA audio posting about Russia’s harvest.

Russia produced 85 million tons of wheat in 2017, up from 72.5 million tons in 2016 and 61 million

tons in 2015.

In addition to bulk commodities, the U.S. is becoming more focused on animal and aquaculture feed,

high-protein foods, fruits, vegetables and other specialty crops.

Shipments of U.S. soybeans and soymeal to East and Southeast Asia, for example, have doubled in the

past decade to 44 million metric tons in 2017. While food uses of beans are increasing, most of the meal

is used to feed those regions’ poultry and swine so they can produce more of their own protein.

www.Agri-Pulse.com 7