Page 47 - Export or Bust eBook

P. 47

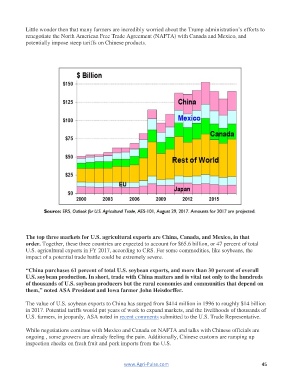

Little wonder then that many farmers are incredibly worried about the Trump administration’s efforts to

renegotiate the North American Free Trade Agreement (NAFTA) with Canada and Mexico, and

potentially impose steep tariffs on Chinese products.

The top three markets for U.S. agricultural exports are China, Canada, and Mexico, in that

order. Together, these three countries are expected to account for $65.6 billion, or 47 percent of total

U.S. agricultural exports in FY 2017, according to CRS. For some commodities, like soybeans, the

impact of a potential trade battle could be extremely severe.

“China purchases 61 percent of total U.S. soybean exports, and more than 30 percent of overall

U.S. soybean production. In short, trade with China matters and is vital not only to the hundreds

of thousands of U.S. soybean producers but the rural economies and communities that depend on

them,” noted ASA President and Iowa farmer John Heisdorffer.

The value of U.S. soybean exports to China has surged from $414 million in 1996 to roughly $14 billion

in 2017. Potential tariffs would put years of work to expand markets, and the livelihoods of thousands of

U.S. farmers, in jeopardy, ASA noted in recent comments submitted to the U.S. Trade Representative.

While negotiations continue with Mexico and Canada on NAFTA and talks with Chinese officials are

ongoing , some growers are already feeling the pain. Additionally, Chinese customs are ramping up

inspection checks on fresh fruit and pork imports from the U.S.

www.Agri-Pulse.com 45