Page 7 - Wade Gephart_Neat

P. 7

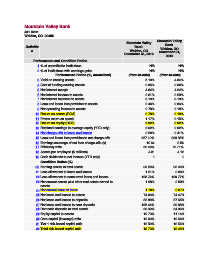

Mountain Valley Bank

461 Main

Walden, CO 80488

Mountain Valley

Mountain Valley

Bank

Definitio Bank Walden, CO

n Walden, CO December 31,

December 31, 2016

2015

Performance and Condition Ratios

1 % of unprofitable institutions N/A N/A

2 % of institutions with earnings gains N/A N/A

Performance Ratios (%, annualized) (Year-to-date) (Year-to-date)

3 Yield on earning assets 5.19% 4.54%

4 Cost of funding earning assets 0.35% 0.30%

5 Net interest margin 4.84% 4.24%

6 Noninterest income to assets 0.31% 0.29%

7 Noninterest expense to assets 3.19% 3.19%

8 Loan and lease loss provision to assets 0.43% 0.86%

9 Net operating income to assets 0.78% 0.10%

10 Return on assets (ROA) 0.78% 0.10%

11 Pretax return on assets 1.17% 0.15%

12 Return on equity (ROE) 6.92% 0.92%

13 Retained earnings to average equity (YTD only) 6.92% 0.92%

0.20% 0.41%

14 Net charge-offs to loans and leases

15 Loan and lease loss provision to net charge-offs 287.19% 303.85%

16 Earnings coverage of net loan charge-offs (x) 10.64 3.56

17 Efficiency ratio 62.45% 70.71%

18 Assets per employee ($ millions) 4.81 4.12

19 Cash dividends to net income (YTD only) 0 0

Condition Ratios (%)

20 Earning assets to total assets 93.26% 92.40%

21 Loss allowance to loans and leases 1.21% 0.95%

22 Loss allowance to noncurrent loans and leases 102.74% 109.77%

23 Noncurrent assets plus other real estate owned to 1.08% 0.99%

assets

1.18% 0.87%

24 Noncurrent loans to loans

25 Net loans and leases to assets 74.06% 74.47%

26 Net loans and leases to deposits 88.88% 87.65%

27 Net loans and leases to core deposits 102.44% 99.88%

28 Domestic deposits to total assets 83.33% 84.96%

29 Equity capital to assets 10.79% 11.14%

30 Core capital (leverage) ratio 10.33% 10.68%

31 Tier 1 risk-based capital ratio 12.59% 12.56%

32 Total risk-based capital ratio 13.73% 13.42%