Page 4 - BOD 4-20-17

P. 4

CBA Board of Directors, CBA office, Thursday, April 20, 2:00pm-4:00pm Page 4.

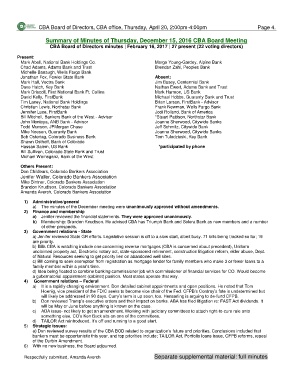

Summary of Minutes of Thursday, December 15, 2016 CBA Board Meeting

CBA Board of Directors minutes | February 16, 2017 | 27 present (22 voting directors)

Present:

Mark Abell, National Bank Holdings Co. Margo Young-Gardey, Alpine Bank

Chad Adams, Adams Bank and Trust Brendan Zahl, Peoples Bank

Michelle Banaugh, Wells Fargo Bank

Jonathan Fox, Fowler State Bank Absent:

Mark Hall, Vectra Bank Jim Basey, Centennial Bank

Dave Hatch, Key Bank Nathan Ewert, Adams Bank and Trust

Mark Driscoll, First National Bank Ft. Collins Mark Harmon, US Bank

David Kelly, FirstBank Michael Hobbs, Guaranty Bank and Trust

Tim Laney, National Bank Holdings Brian Larson, FirstBank - Advisor

Christian Lewis, Northstar Bank Frank Newman, Wells Fargo Bank

Jennifer Luce, FirstBank Jodi Rolland, Bank of America

Bill Mitchell, Bankers Bank of the West - Advisor *Stuart Pattison, Northstar Bank

John Montoya, ANB Bank - Advisor Joanne Sherwood, Citywide Banks

Todd Munson, JPMorgan Chase Jeff Schmitz, Citywide Bank

Mike Noesen, Guaranty Bank Joanne Sherwood, Citywide Banks

Bob Ostertag, Colorado Business Bank Tom Tulodzieski, Key Bank

Shawn Osthoff, Bank of Colorado

Hassan Salem, US Bank *participated by phone

Bill Sullivan, Colorado State Bank and Trust

Michael Wamsganz, Bank of the West

Others Present:

Don Childears, Colorado Bankers Association

Jenifer Waller, Colorado Bankers Association

Mike Bintner, Colorado Bankers Association

Brandon Knudtson, Colorado Bankers Association

Amanda Averch, Colorado Bankers Association

1) Administrative/general

a) The minutes of the December meeting were unanimously approved without amendments.

2) Finance and membership

a) Jenifer reviewed the financial statements. They were approved unanimously.

b) Membership: Brandon Knudtson. He advised CBA has Triumph Bank and Solera Bank as new members and a number

of other prospects.

3) Government relations - State

a) Jenifer reviewed State GR efforts. Legislative session is off to a slow start, albeit busy. 71 bills being tracked so far; 19

are priority.

b) Bills CBA is watching include one concerning reverse mortgages (CBA is concerned about precedent), Uniform

unclaimed property act, Electronic notary act, state-sponsored retirement, construction litigation reform, elder abuse, Dept.

of Natural Resources seeking to get priority lien on abandoned well sites.

c) Bill coming to seek exemption from registration as mortgage lender for family members who make 3 or fewer loans to a

family member within a year’s time.

d) Idea being floated to combine banking commissioner job with commissioner of financial services for CO. Would become

a gubernatorial appointment (cabinet) position. Most states operate that way.

4) Government relations – Federal

a) It is a rapidly changing environment. Don detailed cabinet appointments and open positions. He noted that Tom

Hoenig, vice president of the FDIC seeks to become vice chair of the Fed. CFPB’s Cordray’s fate is undetermined but

will likely be addressed in 90 days. Curry’s term is up soon, too. Hensarling is arguing to de-fund CFPB.

b) Don reviewed Trump’s executive orders and their impact on banks. ABA has filed litigation re: FAST Act dividends. It

will be May or June before anything is known on the case.

c) ADA issue- not likely to get an amendment. Working with judiciary committees to attach right-to-cure rule onto

something else. CO’s Ken Buck sits on one of the committees.

d) TAILOR Act reintroduced. It’s off and running to a good start.

5) Strategic issues:

a) Don reviewed survey results of the CBA BOD related to organization’s future and priorities. Conclusions included that

bankers must be opportunistic this year, and top priorities include; TAILOR Act, Portfolio loans issue, CFPB reforms, repeal

of the Durbin Amendment.

6) With no new business, the Board adjourned.

Respectfully submitted, Amanda Averch Separate supplemental material: full minutes