Page 8 - BOD 4-20-17

P. 8

CBA Board of Directors, CBA office, Thursday, April 20, 2:00pm-4:00pm Page 8.

State Issues

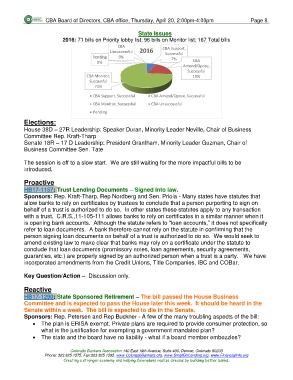

2016: 71 bills on Priority lobby list; 96 bills on Monitor list; 167 Total bills

CBA CBA Support,

Unsuccessful 2016

Successful

Pending 0% 7%

0% CBA

Amend/Opose,

Successful

CBA Monitor, 19%

Successful

74%

CBA Support, Successful CBA Amend/Opose, Successful

CBA Monitor, Successful CBA Unsuccessful

Pending

Elections:

House 38D – 27R Leadership: Speaker Duran, Minority Leader Neville, Chair of Business

Committee Rep. Kraft-Tharp

Senate 18R – 17 D Leadership: President Grantham, Minority Leader Guzman, Chair of

Business Committee Sen. Tate

The session is off to a slow start. We are still waiting for the more impactful bills to be

introduced.

Proactive

HB17-1157: Trust Lending Documents – Signed into law.

Sponsors: Rep. Kraft-Tharp, Rep Nordberg and Sen. Priola - Many states have statutes that

allow banks to rely on certificates by trustees to conclude that a person purporting to sign on

behalf of a trust is authorized to do so. In other states these statutes apply to any transaction

with a trust. C.R.S.,11-105-111 allows banks to rely on certificates in a similar manner when it

is opening bank accounts. Although the statute refers to “loan accounts,” it does not specifically

refer to loan documents. A bank therefore cannot rely on the statute in confirming that the

person signing loan documents on behalf of a trust is authorized to do so. We would seek to

amend existing law to make clear that banks may rely on a certificate under the statute to

conclude that loan documents (promissory notes, loan agreements, security agreements,

guaranties, etc.) are properly signed by an authorized person when a trust is a party. We have

incorporated amendments from the Credit Unions, Title Companies, IBC and COBar.

Key Question/Action – Discussion only.

Reactive

HB17-1290: State Sponsored Retirement – The bill passed the House Business

Committee and is expected to pass the House later this week. It should be heard in the

Senate within a week. The bill is expected to die in the Senate.

Sponsors: Rep. Petersen and Rep Buckner - A few of the many troubling aspects of the bill:

• The plan is ERISA exempt. Private plans are required to provide consumer protection, so

what is the justification for exempting a government mandated plan?

• The state and the board have no liability - what if a board member embezzles?

Colorado Bankers Association 140 East 19th Avenue, Suite 400, Denver, Colorado 80203

Phone: 303.825.1575, Fax:303.825.1585, www.ColoradoBankers.org, www.SmallBizLending.org, www.FinancialInfo.org

Creating a stronger economy and helping Coloradans realize dreams by building better banks.