Page 13 - Flipbook for non-members

P. 13

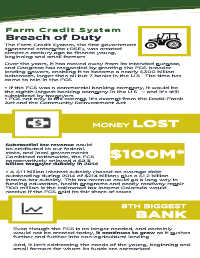

Farm Credit System

Breach of Duty

The Farm Credit System, the first government

sponsored enterprise (GSE), was created

almost a century ago to finance young,

beginning and small farmers.

Over the years, it has moved away from its intended purpose,

and Congress has responded by granting the FCS broader

lending powers, enabling it to become a nearly $300 billion

behemoth, larger than all but 7 banks in the U.S. The time has

come to rein in the FCS.

• If the FCS was a commercial banking company, it would be

the eighth-largest banking company in the U.S. – and it’s still

subsidized by taxpayers

• FCS not only is tax exempt, it’s exempt from the Dodd-Frank

Act and the Community Reinvestment Act

MONEY LOST

Substantial tax revenue could

be attributed to our federal,

state, and local governments. $100M*

Combined nationwide, the FCS

conservatively enjoyed a $2.3

billion taxpayer subsidy in 2014

• A $1.1 billion interest subsidy (based on average debt

outstanding during 2014 of $214 billion) plus a $1.2 billion

income-tax subsidy. This tax revenue could go a long way in

funding education, health programs and costly roadway repair.

*100 million is the estimated tax income Colorado would

receive if the FCS paid its fair share of taxes.

8TH BIGGEST

BANK

Even though the FCS is no longer needed, and certainly

would not be created today, it continues to grow as it pushes

further and further into non-agricultural lending.

And, it isn’t addressing the needs of the young, beginning and

small farmers for whom its funds are earmarked.