Page 15 - Flipbook for non-members

P. 15

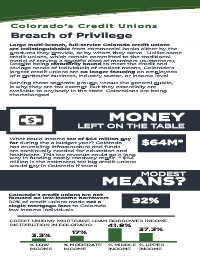

Colorado’s Credit Unions

Breach of Privilege

Large multi-branch, full-service Colorado credit unions

are indistinguishable from commercial banks either by the

products they provide, or by whom they serve. Unlike some

credit unions, which remain committed to the traditional

model of serving a specific class of members (customers),

Despite being statutorily bound to meet the credit and

savings needs of individuals of modest means, Colorado’s

largest credit unions are no longer focusing on employees

of a particular business, industry sector, or income level.

Serving these separate groups, versus the general public,

is why they are tax exempt. But they essentially are

available to anybody in the state. Coloradans are being

shortchanged.

MONEY

LEFT ON THE TABLE

What could income tax of $64 million pay

for during the a budget year? Colorado $64M*

has crumbling infrastructure and funds

are continually needed for education and

healthcare. This tax revenue could go a long

way in funding costly roadway repair. * $64

million is the estimated tax big credit unions

would pay in Colorado if taxed.

MODEST

MEANS?

Colorado’s credit unions are not

focused on low-income borrowers. 92%

92% of credit unions made not a

single mortgage loan to Colorado

low income individuals.

CREDIT UNIONS’ MORTGAGE LOAN BORROWER INCOME

DISTRIBUTION IN COLORADO 41.9%

37.3%

17%

3.3%

% LOW % MODERATE % MIDDLE % UPPER

INCOME INCOME INCOME INCOME