Page 76 - The Informed Fed--Hearn (edited 10.29.20)

P. 76

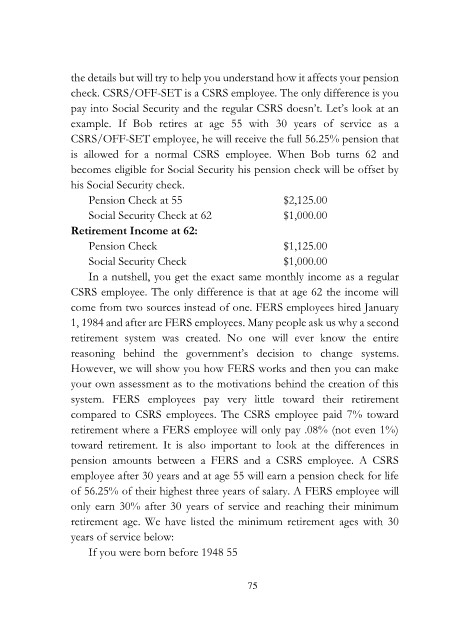

the details but will try to help you understand how it affects your pension

check. CSRS/OFF-SET is a CSRS employee. The only difference is you

pay into Social Security and the regular CSRS doesn’t. Let’s look at an

example. If Bob retires at age 55 with 30 years of service as a

CSRS/OFF-SET employee, he will receive the full 56.25% pension that

is allowed for a normal CSRS employee. When Bob turns 62 and

becomes eligible for Social Security his pension check will be offset by

his Social Security check.

Pension Check at 55 $2,125.00

Social Security Check at 62 $1,000.00

Retirement Income at 62:

Pension Check $1,125.00

Social Security Check $1,000.00

In a nutshell, you get the exact same monthly income as a regular

CSRS employee. The only difference is that at age 62 the income will

come from two sources instead of one. FERS employees hired January

1, 1984 and after are FERS employees. Many people ask us why a second

retirement system was created. No one will ever know the entire

reasoning behind the government’s decision to change systems.

However, we will show you how FERS works and then you can make

your own assessment as to the motivations behind the creation of this

system. FERS employees pay very little toward their retirement

compared to CSRS employees. The CSRS employee paid 7% toward

retirement where a FERS employee will only pay .08% (not even 1%)

toward retirement. It is also important to look at the differences in

pension amounts between a FERS and a CSRS employee. A CSRS

employee after 30 years and at age 55 will earn a pension check for life

of 56.25% of their highest three years of salary. A FERS employee will

only earn 30% after 30 years of service and reaching their minimum

retirement age. We have listed the minimum retirement ages with 30

years of service below:

If you were born before 1948 55

75