Page 63 - Mumme Booklet

P. 63

DRAFT

DOUG AND MARIE MUMME

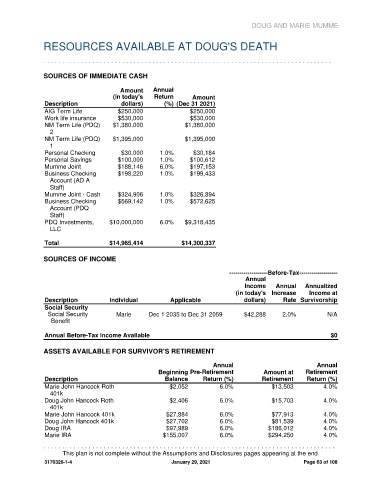

RESOURCES AVAILABLE AT DOUG'S DEATH

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SOURCES OF IMMEDIATE CASH

Amount Annual

(in today's Return Amount

Description dollars) (%) (Dec 31 2021)

AIG Term Life $250,000 $250,000

Work life insurance $530,000 $530,000

NM Term Life (PDQ) $1,380,000 $1,380,000

2

NM Term Life (PDQ) $1,395,000 $1,395,000

1

Personal Checking $30,000 1.0% $30,184

Personal Savings $100,000 1.0% $100,612

Mumme Joint $188,146 6.0% $197,153

Business Checking $198,220 1.0% $199,433

Account (AD A

Staff)

Mumme Joint - Cash $324,906 1.0% $326,894

Business Checking $569,142 1.0% $572,625

Account (PDQ

Staff)

PDQ Investments, $10,000,000 6.0% $9,318,435

LLC

Total $14,965,414 $14,300,337

SOURCES OF INCOME

-------------------Before-Tax-------------------

Annual

Income Annual Annualized

(in today's Increase Income at

Description Individual Applicable dollars) Rate Survivorship

Social Security

Social Security Marie Dec 1 2035 to Dec 31 2059 $42,288 2.0% N/A

Benefit

Annual Before-Tax Income Available $0

ASSETS AVAILABLE FOR SURVIVOR’S RETIREMENT

Annual Annual

Beginning Pre-Retirement Amount at Retirement

Description Balance Return (%) Retirement Return (%)

Marie John Hancock Roth $2,052 6.0% $13,503 4.0%

401k

Doug John Hancock Roth $2,406 6.0% $15,703 4.0%

401k

Marie John Hancock 401k $27,884 6.0% $77,913 4.0%

Doug John Hancock 401k $27,702 6.0% $81,539 4.0%

Doug IRA $97,989 6.0% $186,012 4.0%

Marie IRA $155,007 6.0% $294,250 4.0%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 63 of 108