Page 73 - Mumme Booklet

P. 73

DRAFT

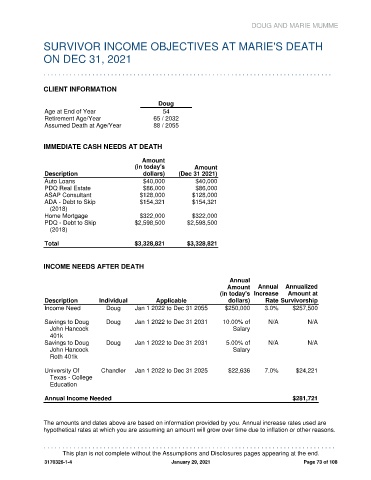

DOUG AND MARIE MUMME

SURVIVOR INCOME OBJECTIVES AT MARIE'S DEATH

ON DEC 31, 2021

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Su r v i v o r I n c o me - Ma r i e

CLIENT INFORMATION

Doug

Age at End of Year 54

Retirement Age/Year 65 / 2032

Assumed Death at Age/Year 88 / 2055

IMMEDIATE CASH NEEDS AT DEATH

Amount

(in today's Amount

Description dollars) (Dec 31 2021)

Auto Loans $40,000 $40,000

PDQ Real Estate $86,000 $86,000

ASAP Consultant $128,000 $128,000

ADA - Debt to Skip $154,321 $154,321

(2018)

Home Mortgage $322,000 $322,000

PDQ - Debt to Skip $2,598,500 $2,598,500

(2018)

Total $3,328,821 $3,328,821

INCOME NEEDS AFTER DEATH

Annual

Amount Annual Annualized

(in today's Increase Amount at

Description Individual Applicable dollars) Rate Survivorship

Income Need Doug Jan 1 2022 to Dec 31 2055 $250,000 3.0% $257,500

Savings to Doug Doug Jan 1 2022 to Dec 31 2031 10.00% of N/A N/A

John Hancock Salary

401k

Savings to Doug Doug Jan 1 2022 to Dec 31 2031 5.00% of N/A N/A

John Hancock Salary

Roth 401k

University Of Chandler Jan 1 2022 to Dec 31 2025 $22,636 7.0% $24,221

Texas - College

Education

Annual Income Needed $281,721

The amounts and dates above are based on information provided by you. Annual increase rates used are

hypothetical rates at which you are assuming an amount will grow over time due to inflation or other reasons.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 73 of 108