Page 89 - Mumme Booklet

P. 89

DRAFT

DOUG AND MARIE MUMME

UNDERSTANDING YOUR RISK PROFILE

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YOUR RISK PROFILE

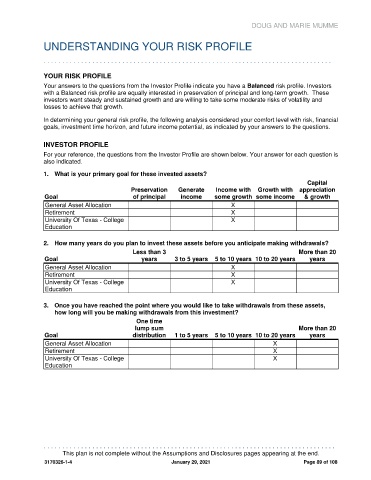

Your answers to the questions from the Investor Profile indicate you have a Balanced risk profile. Investors

with a Balanced risk profile are equally interested in preservation of principal and long-term growth. These

investors want steady and sustained growth and are willing to take some moderate risks of volatility and

losses to achieve that growth.

In determining your general risk profile, the following analysis considered your comfort level with risk, financial

goals, investment time horizon, and future income potential, as indicated by your answers to the questions.

INVESTOR PROFILE

For your reference, the questions from the Investor Profile are shown below. Your answer for each question is

also indicated.

1. What is your primary goal for these invested assets?

Capital

Preservation Generate Income with Growth with appreciation

Goal of principal income some growth some income & growth

General Asset Allocation X

Retirement X

University Of Texas - College X

Education

2. How many years do you plan to invest these assets before you anticipate making withdrawals?

Less than 3 More than 20

Goal years 3 to 5 years 5 to 10 years 10 to 20 years years

General Asset Allocation X

Retirement X

University Of Texas - College X

Education

3. Once you have reached the point where you would like to take withdrawals from these assets,

how long will you be making withdrawals from this investment?

One time

lump sum More than 20

Goal distribution 1 to 5 years 5 to 10 years 10 to 20 years years

General Asset Allocation X

Retirement X

University Of Texas - College X

Education

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 89 of 108