Page 93 - Mumme Booklet

P. 93

DRAFT

DOUG AND MARIE MUMME

ASSUMPTIONS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

As s u mp t i o n s

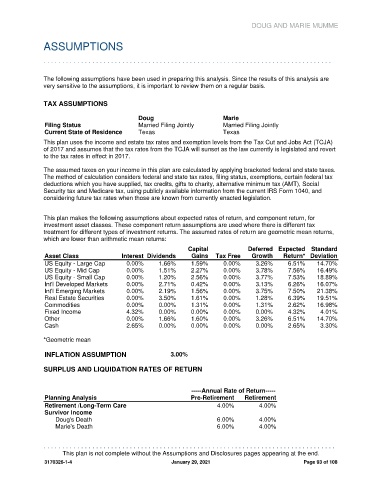

The following assumptions have been used in preparing this analysis. Since the results of this analysis are

very sensitive to the assumptions, it is important to review them on a regular basis.

TAX ASSUMPTIONS

Doug Marie

Filing Status Married Filing Jointly Married Filing Jointly

Current State of Residence Texas Texas

This plan uses the income and estate tax rates and exemption levels from the Tax Cut and Jobs Act (TCJA)

of 2017 and assumes that the tax rates from the TCJA will sunset as the law currently is legislated and revert

to the tax rates in effect in 2017.

The assumed taxes on your income in this plan are calculated by applying bracketed federal and state taxes.

The method of calculation considers federal and state tax rates, filing status, exemptions, certain federal tax

deductions which you have supplied, tax credits, gifts to charity, alternative minimum tax (AMT), Social

Security tax and Medicare tax, using publicly available information from the current IRS Form 1040, and

considering future tax rates when those are known from currently enacted legislation.

This plan makes the following assumptions about expected rates of return, and component return, for

investment asset classes. These component return assumptions are used where there is different tax

treatment for different types of investment returns. The assumed rates of return are geometric mean returns,

which are lower than arithmetic mean returns:

Capital Deferred Expected Standard

Asset Class Interest Dividends Gains Tax Free Growth Return* Deviation

US Equity - Large Cap 0.00% 1.66% 1.59% 0.00% 3.26% 6.51% 14.70%

US Equity - Mid Cap 0.00% 1.51% 2.27% 0.00% 3.78% 7.56% 16.49%

US Equity - Small Cap 0.00% 1.20% 2.56% 0.00% 3.77% 7.53% 18.89%

Int'l Developed Markets 0.00% 2.71% 0.42% 0.00% 3.13% 6.26% 16.07%

Int'l Emerging Markets 0.00% 2.19% 1.56% 0.00% 3.75% 7.50% 21.38%

Real Estate Securities 0.00% 3.50% 1.61% 0.00% 1.28% 6.39% 19.51%

Commodities 0.00% 0.00% 1.31% 0.00% 1.31% 2.62% 16.98%

Fixed Income 4.32% 0.00% 0.00% 0.00% 0.00% 4.32% 4.01%

Other 0.00% 1.66% 1.60% 0.00% 3.26% 6.51% 14.70%

Cash 2.65% 0.00% 0.00% 0.00% 0.00% 2.65% 3.30%

*Geometric mean

INFLATION ASSUMPTION 3.00%

SURPLUS AND LIQUIDATION RATES OF RETURN

-----Annual Rate of Return-----

Planning Analysis Pre-Retirement Retirement

Retirement /Long-Term Care 4.00% 4.00%

Survivor Income

Doug's Death 6.00% 4.00%

Marie's Death 6.00% 4.00%

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This plan is not complete without the Assumptions and Disclosures pages appearing at the end.

3170326-1-4 January 29, 2021 Page 93 of 108