Page 5 - nov-dec2018

P. 5

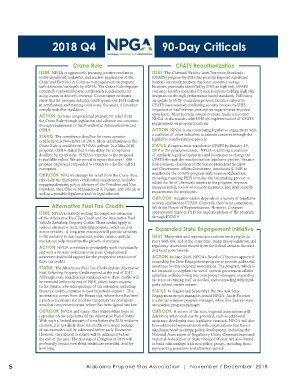

2018 Q4 90-Day Criticals

Crane Rule CFATS Reauthorization

ISSUE NPGA is aggressively pursuing positive resolution ISSUE The Chemical Facility Anti-Terrorism Standards

to the unjustified, unlawful, and unclear application of the (CFATS) program by DHS has recently imposed significant

Crane and Derricks in Construction regulation on propane burdens on certain propane marketer customer storage

tank deliveries/retrievals by OSHA. The Crane Rule imposes locations previously identified by DHS as high risk. CFATS

extremely costly third-party certification requirements for evaluates security measures for such locations holding high risk

using cranes in delivery/retrieval. Conservative estimates designations through performance-based standards. Following

show that the propane industry could spend over $151 million an update to DHS’ evaluation process, facilities subject to

in certification and training costs every five years, if forced to CFATS have received conflicting security reviews by DHS

comply with this regulation. inspectors or had onerous prescriptive requirements imposed

ACTION Increase congressional pressure for relief from upon them. Most recently, several propane marketers joined

the Crane Rule through legislation and advance our concerns NPGA in discussions with DHS on implementation of CFATS

through engagement of the Presidential Administration and requirements on propane locations.

OSHA. ACTION NPGA is also correlating legislative engagement with

a coalition of other industries to address concerns through the

STATUS The compliance deadline for crane operator

certification is November 10, 2018. More information on the legislative reauthorization process.

Crane Rule is available on NPGA’s website. In a May 2018 STATUS Congress must reauthorize CFATS by January 19,

proposal, OSHA stated that it may delay the compliance 2019 or the program sunsets. NPGA is utilizing a coalition

deadline by six months. NPGA’s response to the proposal of similarly regulated industries and businesses to change the

is available online. We are proud to report that over 1,000 CFATS through the reauthorization legislative process. Senator

propane employees responded to OSHA to echo the call for Ron Johnson, chairman of the Senate Homeland Security

exemption. and Government Affairs Committee, introduced S. 3405 to

OUTLOOK NPGA’s strategy for relief from the Crane Rule, reauthorize the CFATS program with some modifications,

especially the third-party certification requirement, includes including requiring DHS to utilize the rulemaking process to

engaging domestic policy advisors of the President and Vice adjust the list of chemicals subject to the program, improve

President, the Office of Management & Budget, and OSHA as transparency in review of security measures, and limit security

well as a possible legislative and/or legal solution. requirements for employees.

OUTLOOK Reauthorization depends on a variety of legislative

Alternative Fuel Tax Credits activity unrelated to CFATS. Currently, there is no companion

bill in the House of Representatives. However, Congress

ISSUE NPGA is actively seeking the long-term extension appropriated funds to DHS for implementation of the program

of the Alternative Fuel Tax Credit and the Alternative Fuel through FY2019.

Vehicle Refueling Property Credit. These credits apply to

various alternative fuels, including propane, when used in Expanded State Engagement Initiative

motor vehicles. A long-term extension will provide certainty

to the industry so that businesses, public entities, and the ISSUE Many state and regional associations are trying to do

market can help maximize the growth of propane. more with less, and at the same time, many major legislative and

ACTION NPGA continues to proactively work individually regulatory issues have moved from the federal arena to the state

and with a broader coalition to increase Congressional and local governments.

awareness and build support for the prospective extension of ACTION In June 2018, NPGA’s Board of Directors approved

these tax credits. expanding the State Engagement program to provide additional

assistance to state/regional associations. The program, which is

STATUS The Alternative Fuel Tax Credit and the Alternative

Fuel Refueling Property Credit expired at the end of 2017. not intended to supplant the states’ current government affaiirs

Although some stakeholders remain positive these credits will activities, includes hiring two new project managers, expanding

be extended before the end of 2018, others have concerns. the roles of existing staff as needed, and contracting with third-

In the Senate, a broader package of tax extenders, including party subject matter experts.

these tax credits, continue to have bipartisan support. The STATUS In August and September, the two new State

uncertainty comes from the House side, where there has been Engagement project managers joined NPGA. Jacob Peterson

a push to reevaluate the need for temporary tax provisions is external relations program manager, while Eric Sears is state

now that comprehensive tax reform has been signed into law. association program manager.

OUTLOOK NPGA and many other stakeholders hope to OUTLOOK A survey of the state/regional associations will

capitalize on the popularity of the Alternative Fuel Credits. determine what needs can be provided, such as additional

With such a limited amount of time before the 2018 midterm assistance developing state legislative outreach. NPGA will also

election, it is not likely these tax credits or a larger package have additional representation with organizations that have a

of tax extenders will be addressed before early November. significant hand in energy policy development, including the

However, they almost certainly will be addressed before National Association of Regulatory Utility Commissioners and

the end of the year. The makeup of Congress in 2019 will National Association of State Energy Officials. We also intend

profoundly impact how these credits are extended, and for to build relationships with new policy groups, including those

how long. representing governors and attorneys general.

5 Alabama Propane Gas Association | November / December 2018