Page 9 - KLSCCCI Nov 2021 - eBulletin 401

P. 9

商会聚焦

KLSCCCI’s response to

recent proposals on

implementation

of new taxes Although the

introduction of the

aforementioned new

It has come to our attention that the government is studying

measures to boost revenue following a statement made by Deputy taxes will seemingly bring in

Finance Minister Yamani Hafez Musa on 22 September 2021. Such more tax revenue for the

measure includes potential introduction of capital gains tax on country and fund various aid

shares. There were also a series of discussions linked to the packages meant for pandemic

re-introduction of inheritance tax in the last 12 months.

The Chinese Chamber of Commerce and Industry of Kuala relief, KLSCCCI do see

Lumpur and Selangor (KLSCCCI) is supportive of government’s drawbacks that could be

proposed measures to boost revenue and would like to offer detrimental to Malaysia’s

comments and views on the implementation of the aforementioned

new taxes. future economic

well-being.

Capital Gains Tax on Shares (CGT)

KLSCCCI believes that CGT will bring a number

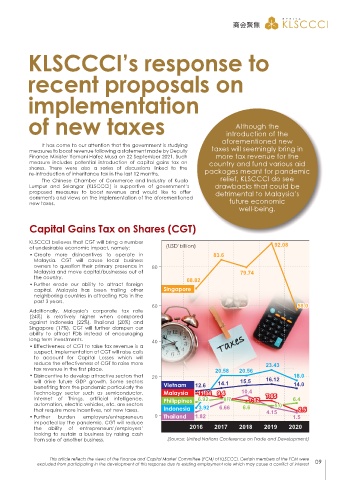

of undesirable economic impact, namely: (USD’billion) 92.08

• Create more disincentives to operate in 83.6

Malaysia. CGT will cause local business

owners to question their primary presence in 80

Malaysia and move capital/businesses out of 79.74

the country. 68.82

• Further erode our ability to attract foreign

capital. Malaysia has been trailing other Singapore

neighboring countries in attracting FDIs in the

past 3 years.

60 58.0

Additionally, Malaysia’s corporate tax rate

(24%) is relatively higher when compared

against Indonesia (22%), Thailand (20%) and

Singapore (17%). CGT will further dampen our

ability to attract FDIs instead of encouraging

long term investments. 40

• Effectiveness of CGT to raise tax revenue is a

suspect. Implementation of CGT will raise calls

to account for Capital Losses which will

reduce the effectiveness of CGT to raise more 23.43

tax revenue in the first place. 20.58 20.56

• Disincentive to develop attractive sectors that 20 18.0

will drive future GDP growth. Some sectors 14.1 15.5 16.12 14.0

benefiting from the pandemic particularly the Vietnam 12.6

Technology sector such as semiconductor, Malaysia 11.34 9.4 10.4

Internet of Things, artificial intelligence, Philippines 6.92 8.7 7.62 7.65 6.4

automation, electric vehicles, etc. are sectors 5.0

that require more incentives, not new taxes. Indonesia 3.92 6.66 6.6 4.15 2.5

• Further burden employers/entrepreneurs 0 Thailand 1.82 1.5

impacted by the pandemic. CGT will reduce

the ability of entrepreneurs’/employers’ 2016 2017 2018 2019 2020

looking to sustain a business by raising cash

from sale of another business. (Source: United Nations Conference on Trade and Development)

This article reflects the views of the Finance and Capital Market Committee (FCM) of KLSCCCI. Certain members of the FCM were

excluded from participating in the development of this response due to existing employment role which may cause a conflict of interest 09