Page 15 - KLSCCCI APR 2022 - eBullentin 405

P. 15

商会动态

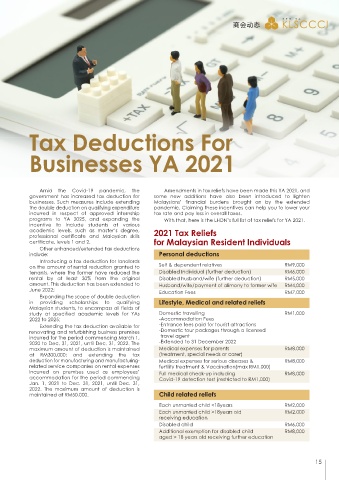

Tax Deductions For

Businesses YA 2021

Amid the Covid-19 pandemic, the Amendments in tax reliefs have been made this YA 2021, and

government has increased tax deduction for some new additions have also been introduced to lighten

businesses. Such measures include extending Malaysians’ financial burdens brought on by the extended

the double deduction on qualifying expenditure pandemic. Claiming these incentives can help you to lower your

incurred in respect of approved internship tax rate and pay less in overall taxes.

programs to YA 2025, and expanding the With that, here is the LHDN’s full list of tax reliefs for YA 2021.

incentive to include students at various

academic levels, such as master’s degree, 2021 Tax Reliefs

professional certificate and Malaysian skills

certificate, levels 1 and 2. for Malaysian Resident Individuals

Other enhanced/extended tax deductions

include: Personal deductions

Introducing a tax deduction for landlords

on the amount of rental reduction granted to Self & dependent relatives RM9,000

tenants, where the former have reduced the Disabled Individual (further deduction) RM6,000

rental by at least 30% from the original Disabled husband/wife (further deduction) RM5,000

amount. This deduction has been extended to Husband/wife/payment of alimony to former wife RM4,000

June 2022; Education Fees RM7,000

Expanding the scope of double deduction

in providing scholarships to qualifying Lifestyle, Medical and related reliefs

Malaysian students, to encompass all fields of

study at specified academic levels for YAs Domestic travelling RM1,000

2022 to 2025; -Accommodation Fees

Extending the tax deduction available for -Entrance fees paid for tourist attractions

renovating and refurbishing business premises -Domestic tour packages through a licensed

incurred for the period commencing March 1, travel agent

2020 to Dec. 31, 2021, until Dec. 31, 2022. The -Extended to 31 December 2022

maximum amount of deduction is maintained Medical expenses for parents RM8,000

at RM300,000; and extending the tax (treatment, special needs or carer)

deduction for manufacturing and manufacturing- Medical expenses for serious diseases & RM8,000

related service companies on rental expenses fertility treatment & Vaccination(max RM1,000)

incurred on premises used as employees’ Full medical check-up including RM8,000

accommodation for the period commencing Covid-19 detection test (restricted to RM1,000)

Jan. 1, 2021 to Dec. 31, 2021, until Dec. 31,

2022. The maximum amount of deduction is

maintained at RM50,000. Child related reliefs

Each unmarried child <18years RM2,000

Each unmarried child >18years old RM2,000

receiving education

Disabled child RM6,000

Additional exemption for disabled child RM8,000

aged > 18 years old receiving further education

15