Page 228 - 2016-2018 Graduate Catalog (Revised)

P. 228

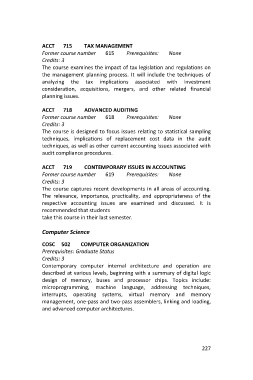

ACCT 715 TAX MANAGEMENT

Former course number 615 Prerequisites: None

Credits: 3

The course examines the impact of tax legislation and regulations on

the management planning process. It will include the techniques of

analyzing the tax implications associated with investment

consideration, acquisitions, mergers, and other related financial

planning issues.

ACCT 718 ADVANCED AUDITING

Former course number 618 Prerequisites: None

Credits: 3

The course is designed to focus issues relating to statistical sampling

techniques, implications of replacement cost data in the audit

techniques, as well as other current accounting issues associated with

audit compliance procedures.

ACCT 719 CONTEMPORARY ISSUES IN ACCOUNTING

Former course number 619 Prerequisites: None

Credits: 3

The course captures recent developments in all areas of accounting.

The relevance, importance, practicality, and appropriateness of the

respective accounting issues are examined and discussed. It is

recommended that students

take this course in their last semester.

Computer Science

COSC 502 COMPUTER ORGANIZATION

Prerequisites: Graduate Status

Credits: 3

Contemporary computer internal architecture and operation are

described at various levels, beginning with a summary of digital logic

design of memory, buses and processor chips. Topics include:

microprogramming, machine language, addressing techniques,

interrupts, operating systems, virtual memory and memory

management, one-pass and two-pass assemblers, linking and loading,

and advanced computer architectures.

227