Page 10 - RosboroAR2020

P. 10

10 — ROSBORO ANNUAL REPORT 2020

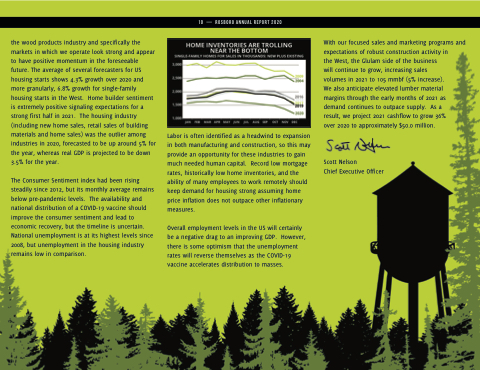

the wood products industry and speci cally the markets in which we operate look strong and appear to have positive momentum in the foreseeable future. The average of several forecasters for US housing starts shows 4.3% growth over 2020 and more granularly, 6.8% growth for single-family housing starts in the West. Home builder sentiment is extremely positive signaling expectations for a strong rst half in 2021. The housing industry (including new home sales, retail sales of building materials and home sales) was the outlier among industries in 2020, forecasted to be up around 5% for the year, whereas real GDP is projected to be down 3.5% for the year.

The Consumer Sentiment index had been rising steadily since 2012, but its monthly average remains below pre-pandemic levels. The availability and national distribution of a COVID-19 vaccine should improve the consumer sentiment and lead to economic recovery, but the timeline is uncertain. National unemployment is at its highest levels since 2008, but unemployment in the housing industry remains low in comparison.

Labor is often identi ed as a headwind to expansion in both manufacturing and construction, so this may provide an opportunity for these industries to gain much needed human capital. Record low mortgage rates, historically low home inventories, and the ability of many employees to work remotely should keep demand for housing strong assuming home price in ation does not outpace other in ationary measures.

Overall employment levels in the US will certainly be a negative drag to an improving GDP. However, there is some optimism that the unemployment rates will reverse themselves as the COVID-19 vaccine accelerates distribution to masses.

With our focused sales and marketing programs and expectations of robust construction activity in

the West, the Glulam side of the business

will continue to grow, increasing sales

volumes in 2021 to 105 mmbf (5% increase). We also anticipate elevated lumber material margins through the early months of 2021 as demand continues to outpace supply. As a result, we project 2021 cash ow to grow 36% over 2020 to approximately $50.0 million.

Scott Nelson

Chief Executive Of cer