Page 8 - RosboroAR2020

P. 8

8 — ROSBORO ANNUAL REPORT 2020

owners. This was 4.2 mmbf more than 2019 and

0.8 mmbf more than projected. The remaining 88.1 mmbf of volume was obtained through open market purchases and was 8.1 mmbf less than the year prior.

Operations: Glulam got off to a strong start in Q1 before COVID-19 derailed what was on track to be a phenomenal year.

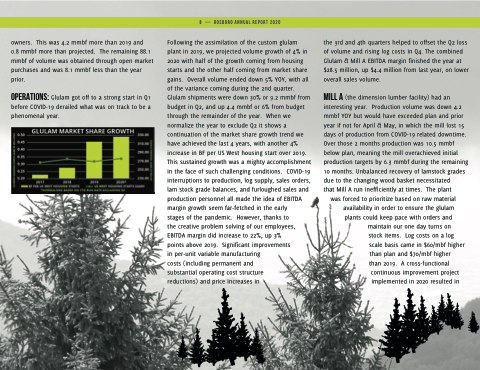

Following the assimilation of the custom glulam plant in 2019, we projected volume growth of 4% in 2020 with half of the growth coming from housing starts and the other half coming from market share gains. Overall volume ended down 5% YOY, with all of the variance coming during the 2nd quarter. Glulam shipments were down 30% or 9.2 mmbf from budget in Q2, and up 4.4 mmbf or 6% from budget through the remainder of the year. When we normalize the year to exclude Q2 it shows a continuation of the market share growth trend we have achieved the last 4 years, with another 4% increase in BF per US West housing start over 2019. This sustained growth was a mighty accomplishment in the face of such challenging conditions. COVID-19 interruptions to production, log supply, sales orders, lam stock grade balances, and furloughed sales and production personnel all made the idea of EBITDA margin growth seem far-fetched in the early

stages of the pandemic. However, thanks to

the creative problem solving of our employees, EBITDA margin did increase to 22%, up 3%

points above 2019. Signi cant improvements

in per-unit variable manufacturing

costs (including permanent and

substantial operating cost structure

reductions) and price increases in

the 3rd and 4th quarters helped to offset the Q2 loss of volume and rising log costs in Q4. The combined Glulam & Mill A EBITDA margin nished the year at $28.5 million, up $4.4 million from last year, on lower overall sales volume.

Mill A (the dimension lumber facility) had an interesting year. Production volume was down 4.2 mmbf YOY but would have exceeded plan and prior year if not for April & May, in which the mill lost 15 days of production from COVID-19 related downtime. Over those 2 months production was 10.5 mmbf below plan, meaning the mill overachieved initial production targets by 6.3 mmbf during the remaining 10 months. Unbalanced recovery of lamstock grades due to the changing wood basket necessitated

that Mill A run inef ciently at times. The plant was forced to prioritize based on raw material

availability in order to ensure the glulam plants could keep pace with orders and maintain our one day turns on

stock items. Log costs on a log scale basis came in $60/mbf higher

than plan and $70/mbf higher than 2019. A cross-functional

continuous improvement project implemented in 2020 resulted in