Page 7 - RosboroAR2020

P. 7

our ability to use a more ef cient log base including short-length logs and our ability to process them ef ciently.

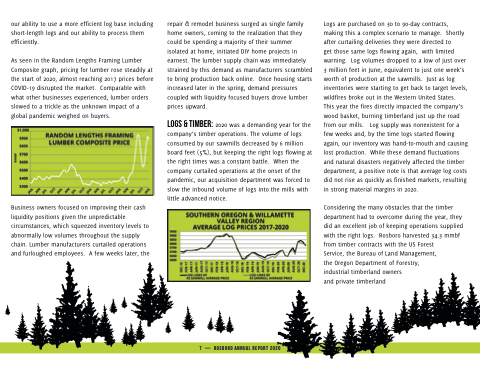

As seen in the Random Lengths Framing Lumber Composite graph, pricing for lumber rose steadily at the start of 2020, almost reaching 2017 prices before COVID-19 disrupted the market. Comparable with what other businesses experienced, lumber orders slowed to a trickle as the unknown impact of a global pandemic weighed on buyers.

Business owners focused on improving their cash liquidity positions given the unpredictable circumstances, which squeezed inventory levels to abnormally low volumes throughout the supply chain. Lumber manufacturers curtailed operations and furloughed employees. A few weeks later, the

repair & remodel business surged as single family home owners, coming to the realization that they could be spending a majority of their summer isolated at home, initiated DIY home projects in earnest. The lumber supply chain was immediately strained by this demand as manufacturers scrambled to bring production back online. Once housing starts increased later in the spring, demand pressures coupled with liquidity focused buyers drove lumber prices upward.

Logs & Timber: 2020 was a demanding year for the company’s timber operations. The volume of logs consumed by our sawmills decreased by 6 million board feet (5%), but keeping the right logs owing at the right times was a constant battle. When the company curtailed operations at the onset of the pandemic, our acquisition department was forced to slow the inbound volume of logs into the mills with little advanced notice.

Logs are purchased on 30 to 90-day contracts, making this a complex scenario to manage. Shortly after curtailing deliveries they were directed to

get those same logs owing again, with limited warning. Log volumes dropped to a low of just over 3 million feet in June, equivalent to just one week’s worth of production at the sawmills. Just as log inventories were starting to get back to target levels, wild res broke out in the Western United States. This year the res directly impacted the company’s wood basket, burning timberland just up the road from our mills. Log supply was nonexistent for a few weeks and, by the time logs started owing again, our inventory was hand-to-mouth and causing lost production. While these demand uctuations and natural disasters negatively affected the timber department, a positive note is that average log costs did not rise as quickly as nished markets, resulting in strong material margins in 2020.

Considering the many obstacles that the timber department had to overcome during the year, they did an excellent job of keeping operations supplied with the right logs. Rosboro harvested 34.3 mmbf from timber contracts with the US Forest

Service, the Bureau of Land Management, the Oregon Department of Forestry, industrial timberland owners

and private timberland

7 — ROSBORO ANNUAL REPORT 2020