Page 5 - RosboroAR2020

P. 5

than 2019, a year which was hampered by unusually dif cult lumber markets as well as the 6-month construction and start-up of a new facility for the newly acquired Western Structures.

Our TTM (trailing twelve month) revenue has grown from $112.6 million in January 2015 to $211.6 million in December of 2020. The TTM EBITDA has also increased over that same span from $12.1 million to $36.5 million in 2020.

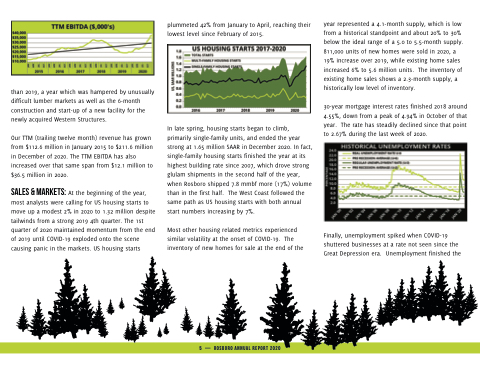

Sales & Markets: At the beginning of the year, most analysts were calling for US housing starts to move up a modest 2% in 2020 to 1.32 million despite tailwinds from a strong 2019 4th quarter. The 1st quarter of 2020 maintained momentum from the end of 2019 until COVID-19 exploded onto the scene causing panic in the markets. US housing starts

plummeted 42% from January to April, reaching their lowest level since February of 2015.

In late spring, housing starts began to climb, primarily single-family units, and ended the year strong at 1.65 million SAAR in December 2020. In fact, single-family housing starts nished the year at its highest building rate since 2007, which drove strong glulam shipments in the second half of the year, when Rosboro shipped 7.8 mmbf more (17%) volume than in the rst half. The West Coast followed the same path as US housing starts with both annual start numbers increasing by 7%.

Most other housing related metrics experienced similar volatility at the onset of COVID-19. The inventory of new homes for sale at the end of the

year represented a 4.1-month supply, which is low from a historical standpoint and about 20% to 30% below the ideal range of a 5.0 to 5.5-month supply. 811,000 units of new homes were sold in 2020, a 19% increase over 2019, while existing home sales increased 6% to 5.6 million units. The inventory of existing home sales shows a 2.3-month supply, a historically low level of inventory.

30-year mortgage interest rates nished 2018 around 4.55%, down from a peak of 4.94% in October of that year. The rate has steadily declined since that point to 2.67% during the last week of 2020.

Finally, unemployment spiked when COVID-19 shuttered businesses at a rate not seen since the Great Depression era. Unemployment nished the

5 — ROSBORO ANNUAL REPORT 2020