Page 9 - RosboroAR2020

P. 9

a dramatic increase in overrun, delivering a 6-point improvement over last year, right on plan. This was just one example of the Company’s efforts to instill a continuous improvement culture and to target speci c and meaningful gains every year, work that once again yielded dramatic results; operations achieved just over $3.0 million of additional operating cost structure improvements in 2020.

Sales of dimension lumber, primarily lumber that does not make lam stock grade, followed the same path as stud lumber with prices helping to improve the combined Mill A & Glulam EBITDA margin. Manufacturing costs suffered from inef cient operations for portions of the year and from low production volumes in April & May. Labor costs were up $3/mbf over plan, but $8/mbf better than 2019. Overall manufacturing costs were $4/mbf higher than plan, but $1/mbf better than 2019.

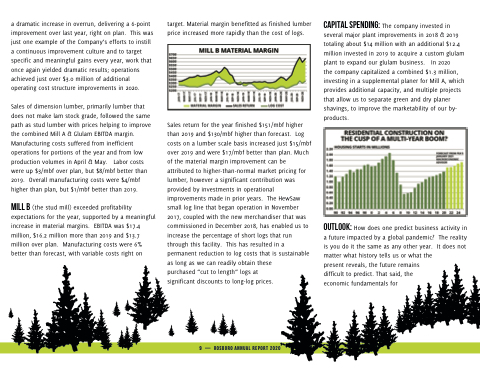

Mill B (the stud mill) exceeded pro tability expectations for the year, supported by a meaningful increase in material margins. EBITDA was $17.4 million, $16.2 million more than 2019 and $13.7 million over plan. Manufacturing costs were 6% better than forecast, with variable costs right on

target. Material margin bene tted as nished lumber price increased more rapidly than the cost of logs.

Sales return for the year nished $151/mbf higher than 2019 and $130/mbf higher than forecast. Log costs on a lumber scale basis increased just $15/mbf over 2019 and were $17/mbf better than plan. Much of the material margin improvement can be attributed to higher-than-normal market pricing for lumber, however a signi cant contribution was provided by investments in operational improvements made in prior years. The HewSaw small log line that began operation in November 2017, coupled with the new merchandiser that was commissioned in December 2018, has enabled us to increase the percentage of short logs that run through this facility. This has resulted in a permanent reduction to log costs that is sustainable as long as we can readily obtain these

purchased “cut to length” logs at signi cant discounts to long-log prices.

Capital Spending: The company invested in several major plant improvements in 2018 & 2019 totaling about $14 million with an additional $12.4 million invested in 2019 to acquire a custom glulam plant to expand our glulam business. In 2020

the company capitalized a combined $1.3 million, investing in a supplemental planer for Mill A, which provides additional capacity, and multiple projects that allow us to separate green and dry planer shavings, to improve the marketability of our by- products.

Outlook: How does one predict business activity in a future impacted by a global pandemic? The reality is you do it the same as any other year. It does not matter what history tells us or what the

present reveals, the future remains dif cult to predict. That said, the economic fundamentals for

9 — ROSBORO ANNUAL REPORT 2020