Page 17 - ANTILL DGB

P. 17

Antilliaans Dagblad Maandag 30 april 2018 ADVERTENTIE 17

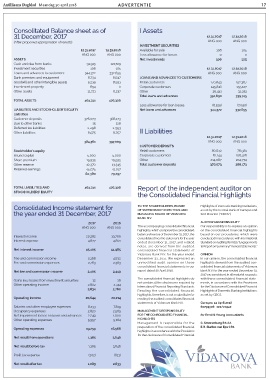

Consolitated Balance sheet as of I Assets

Ƒŏ %åÏåĵÆåųØ ƗljŏƁ 12.31.2017 12.31.2016

&JXIV TVSTSWIH ETTVSTVMEXMSR SJ VIWYPXW &3, &3,

INVESTMENT SECURITIES

12.31.2017 12.31.2016 &ZEMPEFPI JSV WEPI

&3, &3, 1IWW EPPS[ERGI JSV PSWWIW

ASSETS Net investments 106 105

(EWL ERH HYI JVSQ FEROW

.RZIWXQIRX WIGYVMXMIW 12.31.2017 12.31.2016

1SERW ERH EHZERGIW XS GYWXSQIVW &3, &3,

'ERO TVIQMWIW ERH IUYMTQIRX LOANS AND ADVANCES TO CUSTOMERS

,SSH[MPP ERH SXLIV MRXERKMFPI EWWIXW 7IXEMP GYWXSQIVW

.RZIWXQIRX TVSTIVX] (SVTSVEXI GYWXSQIVW

4XLIV EWWIXW 4XLIV

Total loans and advances 352,890 339,745

TOTAL ASSETS 464,741 476,306

1IWW EPPS[ERGI JSV PSER PSWWIW

LIABILITIES AND STOCKHOLDER’S EQUITY Net loans and advances 344,372 332,655

Liabilities

(YWXSQIV HITSWMXW

)YI XS SXLIV FEROW

)IJIVVIH XE\ PMEFMPMXMIW

4XLIV PMEFMPMXMIW II Liabilities

12.31.2017 12.31.2016

384,361 397,009 &3, &3,

CUSTOMER DEPOSITS

Stockholder’s equity 7IXEMP GYWXSQIVW

.WWYIH GETMXEP (SVTSVEXI GYWXSQIVW

LEVI TVIQMYQ 4XLIV

4XLIV VIWIVZI Total customer deposits 376,073 388,173

7IXEMRIH IEVRMRKW

80,380 79,297

TOTAL LIABILITIES AND 464,741 476,306 Report of the independent auditor on

STOCKHOLDERS’ EQUITY

the Consolidated Financial Highlights

Consolidated Income statement for TO THE SHAREHOLDERS, BOARD -MKLPMKLXW SJ )SQIWXMG 'EROMRK .RWXMXYXMSRW

EW WIX F] XLI (IRXVEP 'ERO SJ (YVE±ES ERH

OF SUPERVISORY DIRECTORS AND

ƋĘå Ƽå±ų åĹÚåÚ Ƒŏ %åÏåĵÆåųØ ƗljŏƁ MANAGING BOARD OF VIDANOVA MRX 2EEVXIR Ƹ('( ƹ

BANK N.V.

ȶȉȦȮ ȶȉȦȰ AUDITOR’S RESPONSIBILITY

&3, &3, 8LI EGGSQTER]MRK GSRWSPMHEXIH ǻ RERGMEP 4YV VIWTSRWMFMPMX] MW XS I\TVIWW ER STMRMSR

LMKLPMKLXW [LMGL GSQTVMWI XLI GSRWSPMHEXIH on the consolidated financial highlights

FEPERGI WLIIX EW SJ )IGIQFIV XLI FEWIH SR SYV TVSGIHYVIW [LMGL [IVI

.RXIVIWX MRGSQI

GSRWSPMHEXIH MRGSQI WXEXIQIRX JSV XLI ]IEV GSRHYGXIH MR EGGSVHERGI [MXL .RXIVREXMSREP

.RXIVIWX I\TIRWI

IRHIH )IGIQFIV ERH VIPEXIH XERHEVH SR &YHMXMRK . & Ƹ*RKEKIQIRXW

RSXIW EVI HIVMZIH JVSQ XLI EYHMXIH XS 7ITSVX SR YQQEV] +MRERGMEP XEXIQIRXW ƹ

Net interest income 15,405 14,985 GSRWSPMHEXIH JMRERGMEP WXEXIQIRXW SJ

:MHERSZE 'ERO 3 : JSV XLI ]IEV IRHIH OPINION

+II ERH GSQQMWWMSR MRGSQI )IGIQFIV ;I I\TVIWWIH ER .R SYV STMRMSR XLI GSRWSPMHEXIH ǻ RERGMEP

+II ERH GSQQMWWMSR I\TIRWIW YRQSHMJMIH EYHMX STMRMSR SR XLSWI LMKLPMKLXW HIVMZIH JVSQ XLI EYHMXIH GSR

GSRWSPMHEXIH ǻ RERGMEP WXEXIQIRXW MR SYV WSPMHEXIH ǻ RERGMEP WXEXIQIRXW SJ :MHERSZE

Net fee and commission income 2,405 2,449 VITSVX HEXIH &TVMP 'ERO 3 : JSV XLI ]IEV IRHIH )IGIQFIV

EVI GSRWMWXIRX MR EPP QEXIVMEP VIWTIGXW

8LI GSRWSPMHEXIH ǻ RERGMEP LMKLPMKLXW HS [MXL XLSWI GSRWSPMHEXIH JMRERGMEP WXEXI

,EMRW PIWW PSWWIW JVSQ MRZIWXQIRX WIGYVMXMIW

RSX GSRXEMR EPP XLI HMWGPSWYVIW VIUYMVIH F] QIRXW MR EGGSVHERGI [MXL XLI 5VSZMWMSRW

4XLIV STIVEXMRK MRGSQI

.RXIVREXMSREP +MRERGMEP 7ITSVXMRK XERHEVHW JSV XLI )MWGPSWYVI SJ (SRWSPMHEXIH +MRERGMEP

2,834 2,780

Reading the consolidated financial -MKLPMKLXW SJ )SQIWXMG 'EROMRK .RWXMXYXMSRW

LMKLPMKLXW XLIVIJSVI MW RSX E WYFWXMXYXI JSV EW WIX F] ('(

Operating income 20,644 20,214 VIEHMRK XLI EYHMXIH GSRWSPMHEXIH ǻ RERGMEP

WXEXIQIRXW SJ :MHERSZE 'ERO 3 : (YVE±ES &TVMP

EPEVMIW ERH SXLIV IQTPS]II I\TIRWIW

4GGYTERG] I\TIRWIW MANAGEMENT’S RESPONSIBILITY

3IX MQTEMVQIRX PSWWIW SR PSERW ERH EHZERGIW FOR THE CONSOLIDATED FINANCIAL JSV *VRWX =SYRK &GGSYRXERXW

4XLIV STIVEXMRK I\TIRWIW HIGHLIGHTS

2EREKIQIRX MW VIWTSRWMFPI JSV XLI ( QSVIRFYVK 7& &&

TVITEVEXMSR SJ XLI GSRWSPMHEXIH ǻ RERGMEP * 7 XEXMYW ZER *TW (5&

Operating expenses 19,259 16,568

LMKLPMKLXW MR EGGSVHERGI [MXL XLI 5VSZMWMSRW

JSV XLI )MWGPSWYVI SJ (SRWSPMHEXIH +MRERGMEP

Net result from operations 1,385 3,646

Net result before tax

5VSǻ X XE\ I\TIRWI

Net result after tax 1,083 2,833