Page 59 - Business Valuation for Estates & Gift Taxes

P. 59

Thus, transferable corporate goodwill exists only when the business is not dependent on the professional

skill or other personal characteristics of the owner. Corporate goodwill is the value that stays with the

business exclusive of personal goodwill.

These rulings were superseded by Revenue Ruling 64-235 1964-2 CB 18, and the position of the IRS

Commissioner which, in part, stated the following:

The extent to which the consideration received upon the sale of a professional practice is at-

tributable to goodwill will be determined on the basis of the facts involved in the particular case

and not by whether the business is, or is not, dependent solely upon the professional skill or other

personal characteristics of the owner.

What can be taken from this is that the IRS does not want to be held to a strict interpretation; instead,

each case should be reviewed on its particular facts and circumstances.

A few examples of issues requiring careful consideration before making any judgment about whether

goodwill is of a personal or corporate nature might include the following:

Does the company have a strong reputation and brand name?

Is an infrastructure in place to support services and maintain or increase market share?

Does the company have a specialty or niche service, or does it simply employ one individual

who is a specialist?

Can business attributes be differentiated between the company and the specialist?

Can value be created from firm attributes that are transferable to buyers exclusive of any special-

ist employed?

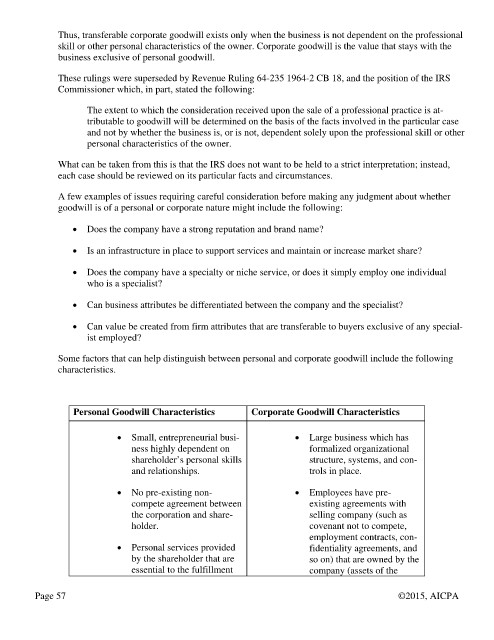

Some factors that can help distinguish between personal and corporate goodwill include the following

characteristics.

Personal Goodwill Characteristics Corporate Goodwill Characteristics

Small, entrepreneurial busi- Large business which has

ness highly dependent on formalized organizational

shareholder’s personal skills structure, systems, and con-

and relationships. trols in place.

No pre-existing non- Employees have pre-

compete agreement between existing agreements with

the corporation and share- selling company (such as

holder. covenant not to compete,

employment contracts, con-

Personal services provided fidentiality agreements, and

by the shareholder that are so on) that are owned by the

essential to the fulfillment company (assets of the

Page 57 ©2015, AICPA