Page 61 - Business Valuation for Estates & Gift Taxes

P. 61

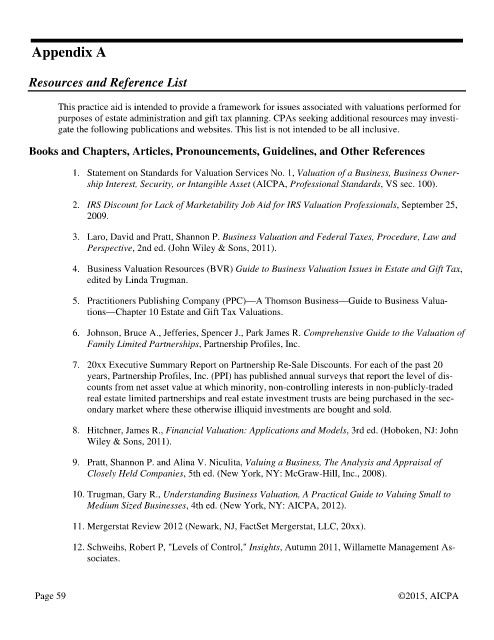

Appendix A

Resources and Reference List

This practice aid is intended to provide a framework for issues associated with valuations performed for

purposes of estate administration and gift tax planning. CPAs seeking additional resources may investi-

gate the following publications and websites. This list is not intended to be all inclusive.

Books and Chapters, Articles, Pronouncements, Guidelines, and Other References

1. Statement on Standards for Valuation Services No. 1, Valuation of a Business, Business Owner-

ship Interest, Security, or Intangible Asset (AICPA, Professional Standards, VS sec. 100).

2. IRS Discount for Lack of Marketability Job Aid for IRS Valuation Professionals, September 25,

2009.

3. Laro, David and Pratt, Shannon P. Business Valuation and Federal Taxes, Procedure, Law and

Perspective, 2nd ed. (John Wiley & Sons, 2011).

4. Business Valuation Resources (BVR) Guide to Business Valuation Issues in Estate and Gift Tax,

edited by Linda Trugman.

5. Practitioners Publishing Company (PPC)—A Thomson Business—Guide to Business Valua-

tions—Chapter 10 Estate and Gift Tax Valuations.

6. Johnson, Bruce A., Jefferies, Spencer J., Park James R. Comprehensive Guide to the Valuation of

Family Limited Partnerships, Partnership Profiles, Inc.

7. 20xx Executive Summary Report on Partnership Re-Sale Discounts. For each of the past 20

years, Partnership Profiles, Inc. (PPI) has published annual surveys that report the level of dis-

counts from net asset value at which minority, non-controlling interests in non-publicly-traded

real estate limited partnerships and real estate investment trusts are being purchased in the sec-

ondary market where these otherwise illiquid investments are bought and sold.

8. Hitchner, James R., Financial Valuation: Applications and Models, 3rd ed. (Hoboken, NJ: John

Wiley & Sons, 2011).

9. Pratt, Shannon P. and Alina V. Niculita, Valuing a Business, The Analysis and Appraisal of

Closely Held Companies, 5th ed. (New York, NY: McGraw-Hill, Inc., 2008).

10. Trugman, Gary R., Understanding Business Valuation, A Practical Guide to Valuing Small to

Medium Sized Businesses, 4th ed. (New York, NY: AICPA, 2012).

11. Mergerstat Review 2012 (Newark, NJ, FactSet Mergerstat, LLC, 20xx).

12. Schweihs, Robert P, "Levels of Control," Insights, Autumn 2011, Willamette Management As-

sociates.

Page 59 ©2015, AICPA