Page 65 - Business Valuation for Estates & Gift Taxes

P. 65

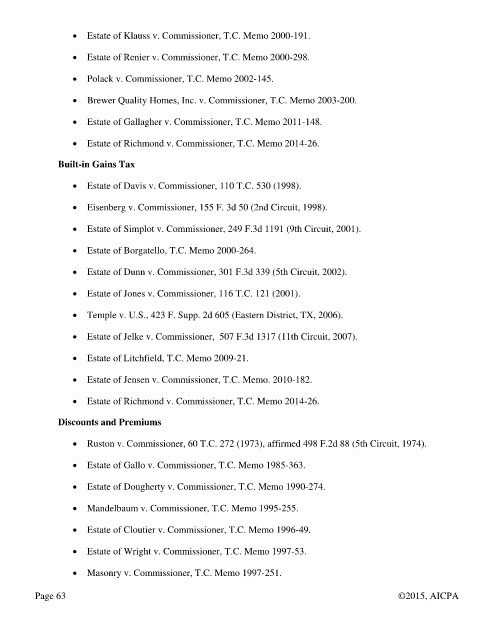

Estate of Klauss v. Commissioner, T.C. Memo 2000-191.

Estate of Renier v. Commissioner, T.C. Memo 2000-298.

Polack v. Commissioner, T.C. Memo 2002-145.

Brewer Quality Homes, Inc. v. Commissioner, T.C. Memo 2003-200.

Estate of Gallagher v. Commissioner, T.C. Memo 2011-148.

Estate of Richmond v. Commissioner, T.C. Memo 2014-26.

Built-in Gains Tax

Estate of Davis v. Commissioner, 110 T.C. 530 (1998).

Eisenberg v. Commissioner, 155 F. 3d 50 (2nd Circuit, 1998).

Estate of Simplot v. Commissioner, 249 F.3d 1191 (9th Circuit, 2001).

Estate of Borgatello, T.C. Memo 2000-264.

Estate of Dunn v. Commissioner, 301 F.3d 339 (5th Circuit, 2002).

Estate of Jones v. Commissioner, 116 T.C. 121 (2001).

Temple v. U.S., 423 F. Supp. 2d 605 (Eastern District, TX, 2006).

Estate of Jelke v. Commissioner, 507 F.3d 1317 (11th Circuit, 2007).

Estate of Litchfield, T.C. Memo 2009-21.

Estate of Jensen v. Commissioner, T.C. Memo. 2010-182.

Estate of Richmond v. Commissioner, T.C. Memo 2014-26.

Discounts and Premiums

Ruston v. Commissioner, 60 T.C. 272 (1973), affirmed 498 F.2d 88 (5th Circuit, 1974).

Estate of Gallo v. Commissioner, T.C. Memo 1985-363.

Estate of Dougherty v. Commissioner, T.C. Memo 1990-274.

Mandelbaum v. Commissioner, T.C. Memo 1995-255.

Estate of Cloutier v. Commissioner, T.C. Memo 1996-49.

Estate of Wright v. Commissioner, T.C. Memo 1997-53.

Masonry v. Commissioner, T.C. Memo 1997-251.

Page 63 ©2015, AICPA