Page 68 - Business Valuation for Estates & Gift Taxes

P. 68

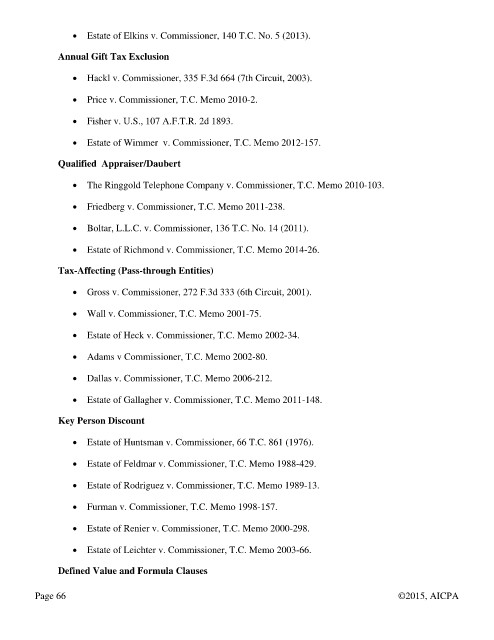

Estate of Elkins v. Commissioner, 140 T.C. No. 5 (2013).

Annual Gift Tax Exclusion

Hackl v. Commissioner, 335 F.3d 664 (7th Circuit, 2003).

Price v. Commissioner, T.C. Memo 2010-2.

Fisher v. U.S., 107 A.F.T.R. 2d 1893.

Estate of Wimmer v. Commissioner, T.C. Memo 2012-157.

Qualified Appraiser/Daubert

The Ringgold Telephone Company v. Commissioner, T.C. Memo 2010-103.

Friedberg v. Commissioner, T.C. Memo 2011-238.

Boltar, L.L.C. v. Commissioner, 136 T.C. No. 14 (2011).

Estate of Richmond v. Commissioner, T.C. Memo 2014-26.

Tax-Affecting (Pass-through Entities)

Gross v. Commissioner, 272 F.3d 333 (6th Circuit, 2001).

Wall v. Commissioner, T.C. Memo 2001-75.

Estate of Heck v. Commissioner, T.C. Memo 2002-34.

Adams v Commissioner, T.C. Memo 2002-80.

Dallas v. Commissioner, T.C. Memo 2006-212.

Estate of Gallagher v. Commissioner, T.C. Memo 2011-148.

Key Person Discount

Estate of Huntsman v. Commissioner, 66 T.C. 861 (1976).

Estate of Feldmar v. Commissioner, T.C. Memo 1988-429.

Estate of Rodriguez v. Commissioner, T.C. Memo 1989-13.

Furman v. Commissioner, T.C. Memo 1998-157.

Estate of Renier v. Commissioner, T.C. Memo 2000-298.

Estate of Leichter v. Commissioner, T.C. Memo 2003-66.

Defined Value and Formula Clauses

Page 66 ©2015, AICPA