Page 21 - IRS Employer Tax Guide

P. 21

9:19 - 23-Dec-2019

Page 20 of 48

Fileid: … ations/P15/2020/A/XML/Cycle07/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

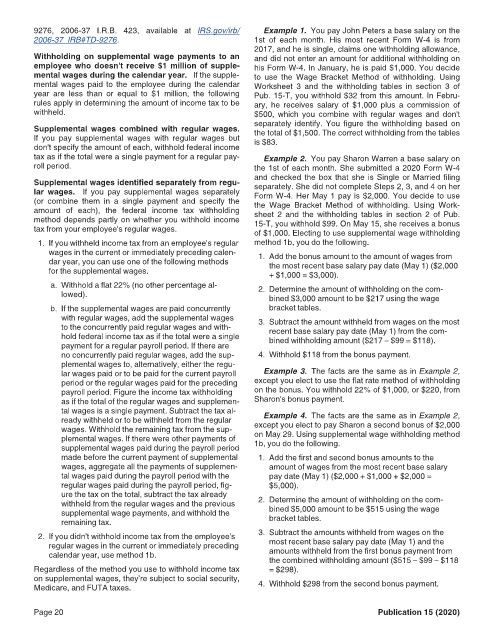

9276, 2006-37 I.R.B. 423, available at IRS.gov/irb/ Example 1. You pay John Peters a base salary on the

2006-37_IRB#TD-9276. 1st of each month. His most recent Form W-4 is from

2017, and he is single, claims one withholding allowance,

Withholding on supplemental wage payments to an and did not enter an amount for additional withholding on

employee who doesn't receive $1 million of supple- his Form W-4. In January, he is paid $1,000. You decide

mental wages during the calendar year. If the supple- to use the Wage Bracket Method of withholding. Using

mental wages paid to the employee during the calendar Worksheet 3 and the withholding tables in section 3 of

year are less than or equal to $1 million, the following Pub. 15-T, you withhold $32 from this amount. In Febru-

rules apply in determining the amount of income tax to be ary, he receives salary of $1,000 plus a commission of

withheld. $500, which you combine with regular wages and don't

Supplemental wages combined with regular wages. separately identify. You figure the withholding based on

the total of $1,500. The correct withholding from the tables

If you pay supplemental wages with regular wages but is $83.

don't specify the amount of each, withhold federal income

tax as if the total were a single payment for a regular pay- Example 2. You pay Sharon Warren a base salary on

roll period. the 1st of each month. She submitted a 2020 Form W-4

Supplemental wages identified separately from regu- and checked the box that she is Single or Married filing

separately. She did not complete Steps 2, 3, and 4 on her

lar wages. If you pay supplemental wages separately Form W-4. Her May 1 pay is $2,000. You decide to use

(or combine them in a single payment and specify the the Wage Bracket Method of withholding. Using Work-

amount of each), the federal income tax withholding sheet 2 and the withholding tables in section 2 of Pub.

method depends partly on whether you withhold income 15-T, you withhold $99. On May 15, she receives a bonus

tax from your employee's regular wages. of $1,000. Electing to use supplemental wage withholding

1. If you withheld income tax from an employee's regular method 1b, you do the following.

wages in the current or immediately preceding calen- 1. Add the bonus amount to the amount of wages from

dar year, you can use one of the following methods the most recent base salary pay date (May 1) ($2,000

for the supplemental wages. + $1,000 = $3,000).

a. Withhold a flat 22% (no other percentage al- 2. Determine the amount of withholding on the com-

lowed). bined $3,000 amount to be $217 using the wage

b. If the supplemental wages are paid concurrently bracket tables.

with regular wages, add the supplemental wages 3. Subtract the amount withheld from wages on the most

to the concurrently paid regular wages and with- recent base salary pay date (May 1) from the com-

hold federal income tax as if the total were a single bined withholding amount ($217 – $99 = $118).

payment for a regular payroll period. If there are

no concurrently paid regular wages, add the sup- 4. Withhold $118 from the bonus payment.

plemental wages to, alternatively, either the regu-

lar wages paid or to be paid for the current payroll Example 3. The facts are the same as in Example 2,

period or the regular wages paid for the preceding except you elect to use the flat rate method of withholding

payroll period. Figure the income tax withholding on the bonus. You withhold 22% of $1,000, or $220, from

as if the total of the regular wages and supplemen- Sharon's bonus payment.

tal wages is a single payment. Subtract the tax al-

Example 4. The facts are the same as in Example 2,

ready withheld or to be withheld from the regular except you elect to pay Sharon a second bonus of $2,000

wages. Withhold the remaining tax from the sup-

plemental wages. If there were other payments of on May 29. Using supplemental wage withholding method

1b, you do the following.

supplemental wages paid during the payroll period

made before the current payment of supplemental 1. Add the first and second bonus amounts to the

wages, aggregate all the payments of supplemen- amount of wages from the most recent base salary

tal wages paid during the payroll period with the pay date (May 1) ($2,000 + $1,000 + $2,000 =

regular wages paid during the payroll period, fig- $5,000).

ure the tax on the total, subtract the tax already

withheld from the regular wages and the previous 2. Determine the amount of withholding on the com-

supplemental wage payments, and withhold the bined $5,000 amount to be $515 using the wage

remaining tax. bracket tables.

2. If you didn't withhold income tax from the employee's 3. Subtract the amounts withheld from wages on the

regular wages in the current or immediately preceding most recent base salary pay date (May 1) and the

calendar year, use method 1b. amounts withheld from the first bonus payment from

the combined withholding amount ($515 – $99 – $118

Regardless of the method you use to withhold income tax = $298).

on supplemental wages, they’re subject to social security,

Medicare, and FUTA taxes. 4. Withhold $298 from the second bonus payment.

Page 20 Publication 15 (2020)