Page 28 - IRS Employer Tax Guide

P. 28

9:19 - 23-Dec-2019

Page 27 of 48

Fileid: … ations/P15/2020/A/XML/Cycle07/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Wednesday through Friday and Saturday through Tues- Semiweekly deposit period spanning two quarters

day. (Form 941 filers). If you have more than one pay date

If you're an agent with an approved Form 2678, during a semiweekly period and the pay dates fall in differ-

TIP the deposit rules apply to you based on the total ent calendar quarters, you’ll need to make separate de-

posits for the separate liabilities.

employment taxes accumulated by you for your

own employees and on behalf of all employers for whom Example. If you have a pay date on Wednesday,

you're authorized to act. For more information on an agent September 30, 2020 (third quarter), and another pay date

with an approved Form 2678, see Revenue Procedure on Thursday, October 1, 2020 (fourth quarter), two sepa-

2013-39, 2013-52 I.R.B. 830, available at IRS.gov/irb/ rate deposits would be required even though the pay

2013-52_IRB#RP-2013-39. dates fall within the same semiweekly period. Both depos-

its would be due Wednesday, October 7, 2020.

Monthly Deposit Schedule Semiweekly deposit period spanning two return peri-

You’re a monthly schedule depositor for a calendar year if ods (Form 944 or Form 945 filers). The period covered

by a return is the return period. The return period for an-

the total taxes on Form 941, line 12, for the 4 quarters in nual Forms 944 and 945 is a calendar year. If you have

your lookback period were $50,000 or less. Under the more than one pay date during a semiweekly period and

monthly deposit schedule, deposit employment taxes on the pay dates fall in different return periods, you'll need to

payments made during a month by the 15th day of the fol- make separate deposits for the separate liabilities. For ex-

lowing month. See also Deposits Due on Business Days ample, if you have a pay date on Wednesday, December

Only and the $100,000 Next-Day Deposit Rule, later in 30, 2020, and another pay date on Friday, January 1,

this section. Monthly schedule depositors shouldn't file 2021, two separate deposits will be required even though

Form 941 or Form 944 on a monthly basis. the pay dates fall within the same semiweekly period.

New employers. Your tax liability for any quarter in the Both deposits will be due Wednesday, January 6, 2021 (3

lookback period before you started or acquired your busi- business days from the end of the semiweekly deposit pe-

ness is considered to be zero. Therefore, you’re a monthly riod).

schedule depositor for the first calendar year of your busi-

ness. However, see the $100,000 Next-Day Deposit Rule, Summary of Steps to Determine Your Deposit Schedule

later in this section. 1. Identify your lookback period (see Lookback period, earlier in

this section).

Semiweekly Deposit Schedule 2. Add the total taxes you reported on Form 941, line 12, during

the lookback period.

You’re a semiweekly schedule depositor for a calendar 3. Determine if you’re a monthly or semiweekly schedule

depositor:

year if the total taxes on Form 941, line 12, during your

lookback period were more than $50,000. Under the semi- IF the total taxes you THEN you’re a . . . . . . . . .

weekly deposit schedule, deposit employment taxes for reported in the lookback

payments made on Wednesday, Thursday, and/or Friday period were . . . . . . . . . . .

by the following Wednesday. Deposit taxes for payments $50,000 or less monthly schedule depositor.

made on Saturday, Sunday, Monday, and/or Tuesday by more than $50,000 semiweekly schedule

the following Friday. See also Deposits Due on Business depositor.

Days Only, later in this section.

Semiweekly schedule depositors must complete

! Schedule B (Form 941), Report of Tax Liability for Example of Monthly and Semiweekly

CAUTION Semiweekly Schedule Depositors, and submit it Schedules

with Form 941. If you file Form 944 or Form 945 and are a

semiweekly schedule depositor, complete Form 945-A, Rose Co. reported Form 941 taxes as follows:

Annual Record of Federal Tax Liability, and submit it with

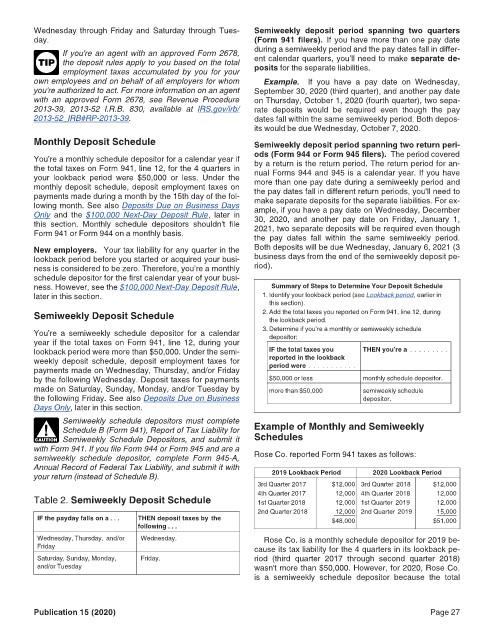

your return (instead of Schedule B). 2019 Lookback Period 2020 Lookback Period

3rd Quarter 2017 $12,000 3rd Quarter 2018 $12,000

4th Quarter 2017 12,000 4th Quarter 2018 12,000

Table 2. Semiweekly Deposit Schedule 1st Quarter 2018 12,000 1st Quarter 2019 12,000

2nd Quarter 2018 12,000 2nd Quarter 2019 15,000

IF the payday falls on a . . . THEN deposit taxes by the $48,000 $51,000

following . . .

Wednesday, Thursday, and/or Wednesday. Rose Co. is a monthly schedule depositor for 2019 be-

Friday cause its tax liability for the 4 quarters in its lookback pe-

Saturday, Sunday, Monday, Friday. riod (third quarter 2017 through second quarter 2018)

and/or Tuesday wasn't more than $50,000. However, for 2020, Rose Co.

is a semiweekly schedule depositor because the total

Publication 15 (2020) Page 27