Page 7 - IRS Employer Tax Guide

P. 7

9:19 - 23-Dec-2019

Page 6 of 48

Fileid: … ations/P15/2020/A/XML/Cycle07/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

nonpayroll (Form 945) withholding. Nonpayroll items

Federal Income Tax include the following.

Withholding • Pensions (including distributions from tax-favored

retirement plans, for example, section 401(k), section

Withhold federal income tax from each wage payment or 403(b), and governmental section 457(b) plans),

annuities, and IRA distributions.

supplemental unemployment compensation plan benefit

payment according to the employee's Form W-4 and the • Military retirement.

correct withholding table in Pub. 15-T. If you're paying • Gambling winnings.

supplemental wages to an employee, see section 7. If you

have nonresident alien employees, see Withholding • Indian gaming profits.

income taxes on the wages of nonresident alien • Certain government payments on which the recipient

employees in section 9. elected voluntary income tax withholding.

See section 8 of Pub. 15-A, Employer’s Supplemental

Tax Guide, for information about withholding on pensions • Dividends and other distributions by an ANC on which

(including distributions from tax-favored retirement plans), the recipient elected voluntary income tax withholding.

annuities, and individual retirement arrangements (IRAs). • Payments subject to backup withholding.

For details on depositing and reporting nonpayroll

Nonpayroll Income Tax income tax withholding, see the Instructions for Form 945.

Distributions from nonqualified pension plans and

Withholding deferred compensation plans. Because distributions to

participants from some nonqualified pension plans and

Nonpayroll federal income tax withholding (reported on deferred compensation plans (including section 457(b)

Forms 1099 and Form W-2G, Certain Gambling plans of tax-exempt organizations) are treated as wages

Winnings) must be reported on Form 945, Annual Return and are reported on Form W-2, income tax withheld must

of Withheld Federal Income Tax. Separate deposits are be reported on Form 941 or Form 944, not on Form 945.

required for payroll (Form 941 or Form 944) and However, distributions from such plans to a beneficiary or

estate of a deceased employee aren't wages and are re-

ported on Forms 1099-R, Distributions From Pensions,

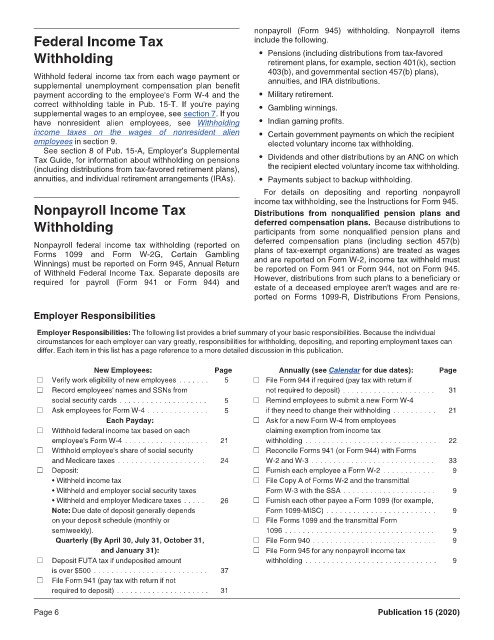

Employer Responsibilities

Employer Responsibilities: The following list provides a brief summary of your basic responsibilities. Because the individual

circumstances for each employer can vary greatly, responsibilities for withholding, depositing, and reporting employment taxes can

differ. Each item in this list has a page reference to a more detailed discussion in this publication.

New Employees: Page Annually (see Calendar for due dates): Page

Verify work eligibility of new employees . . . . . . . 5 File Form 944 if required (pay tax with return if

Record employees' names and SSNs from not required to deposit) . . . . . . . . . . . . . . . . . . . . . 31

social security cards . . . . . . . . . . . . . . . . . . . . 5 Remind employees to submit a new Form W-4

Ask employees for Form W-4 . . . . . . . . . . . . . . 5 if they need to change their withholding . . . . . . . . . . 21

Each Payday: Ask for a new Form W-4 from employees

Withhold federal income tax based on each claiming exemption from income tax

employee's Form W-4 . . . . . . . . . . . . . . . . . . . 21 withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Withhold employee's share of social security Reconcile Forms 941 (or Form 944) with Forms

and Medicare taxes . . . . . . . . . . . . . . . . . . . . 24 W-2 and W-3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Deposit: Furnish each employee a Form W-2 . . . . . . . . . . . . 9

• Withheld income tax File Copy A of Forms W-2 and the transmittal

• Withheld and employer social security taxes Form W-3 with the SSA . . . . . . . . . . . . . . . . . . . . . 9

• Withheld and employer Medicare taxes . . . . . 26 Furnish each other payee a Form 1099 (for example,

Note: Due date of deposit generally depends Form 1099-MISC) . . . . . . . . . . . . . . . . . . . . . . . . . 9

on your deposit schedule (monthly or File Forms 1099 and the transmittal Form

semiweekly). 1096 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Quarterly (By April 30, July 31, October 31, File Form 940 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

and January 31): File Form 945 for any nonpayroll income tax

Deposit FUTA tax if undeposited amount withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

is over $500 . . . . . . . . . . . . . . . . . . . . . . . . . . 37

File Form 941 (pay tax with return if not

required to deposit) . . . . . . . . . . . . . . . . . . . . . 31

Page 6 Publication 15 (2020)