Page 167 - Internal Auditing Standards

P. 167

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

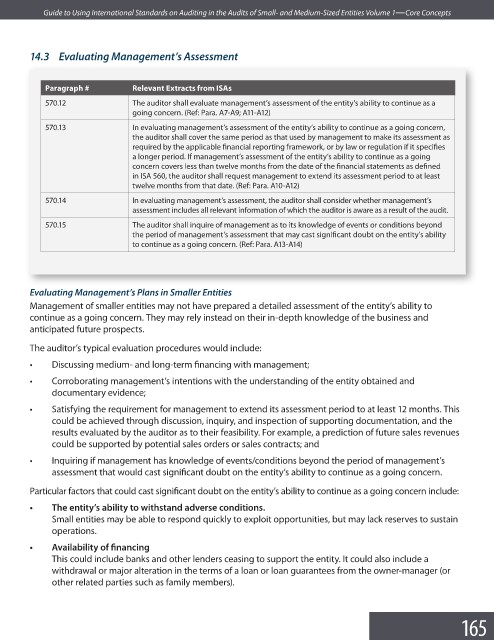

14.3 Evaluating Management’s Assessment

Paragraph # Relevant Extracts from ISAs

570.12 The auditor shall evaluate management’s assessment of the entity’s ability to continue as a

going concern. (Ref: Para. A7-A9; A11-A12)

570.13 In evaluating management’s assessment of the entity’s ability to continue as a going concern,

the auditor shall cover the same period as that used by management to make its assessment as

required by the applicable financial reporting framework, or by law or regulation if it specifi es

a longer period. If management’s assessment of the entity’s ability to continue as a going

concern covers less than twelve months from the date of the financial statements as defi ned

in ISA 560, the auditor shall request management to extend its assessment period to at least

twelve months from that date. (Ref: Para. A10-A12)

570.14 In evaluating management’s assessment, the auditor shall consider whether management’s

assessment includes all relevant information of which the auditor is aware as a result of the audit.

570.15 The auditor shall inquire of management as to its knowledge of events or conditions beyond

the period of management’s assessment that may cast significant doubt on the entity’s ability

to continue as a going concern. (Ref: Para. A13-A14)

Evaluating Management’s Plans in Smaller Entities

Management of smaller entities may not have prepared a detailed assessment of the entity’s ability to

continue as a going concern. They may rely instead on their in-depth knowledge of the business and

anticipated future prospects.

The auditor’s typical evaluation procedures would include:

• Discussing medium- and long-term financing with management;

• Corroborating management’s intentions with the understanding of the entity obtained and

documentary evidence;

• Satisfying the requirement for management to extend its assessment period to at least 12 months. This

could be achieved through discussion, inquiry, and inspection of supporting documentation, and the

results evaluated by the auditor as to their feasibility. For example, a prediction of future sales revenues

could be supported by potential sales orders or sales contracts; and

• Inquiring if management has knowledge of events/conditions beyond the period of management’s

assessment that would cast significant doubt on the entity’s ability to continue as a going concern.

Particular factors that could cast significant doubt on the entity’s ability to continue as a going concern include:

• The entity’s ability to withstand adverse conditions.

Small entities may be able to respond quickly to exploit opportunities, but may lack reserves to sustain

operations.

• Availability of fi nancing

This could include banks and other lenders ceasing to support the entity. It could also include a

withdrawal or major alteration in the terms of a loan or loan guarantees from the owner-manager (or

other related parties such as family members).

165