Page 170 - Internal Auditing Standards

P. 170

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

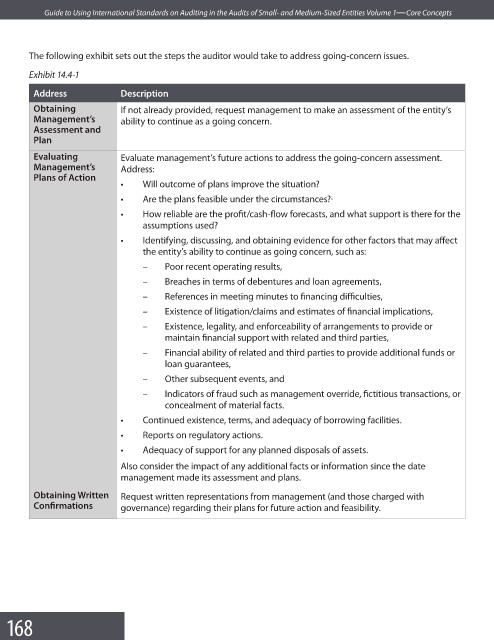

The following exhibit sets out the steps the auditor would take to address going-concern issues.

Exhibit 14.4-1

Address Description

Obtaining If not already provided, request management to make an assessment of the entity’s

Management’s ability to continue as a going concern.

Assessment and

Plan

Evaluating Evaluate management’s future actions to address the going-concern assessment.

Management’s Address:

Plans of Action

• Will outcome of plans improve the situation?

• Are the plans feasible under the circumstances?

• How reliable are the profi t/cash-flow forecasts, and what support is there for the

assumptions used?

• Identifying, discussing, and obtaining evidence for other factors that may aff ect

the entity’s ability to continue as going concern, such as:

– Poor recent operating results,

– Breaches in terms of debentures and loan agreements,

– References in meeting minutes to fi nancing diffi culties,

– Existence of litigation/claims and estimates of fi nancial implications,

– Existence, legality, and enforceability of arrangements to provide or

maintain financial support with related and third parties,

– Financial ability of related and third parties to provide additional funds or

loan guarantees,

– Other subsequent events, and

– Indicators of fraud such as management override, fictitious transactions, or

concealment of material facts.

• Continued existence, terms, and adequacy of borrowing facilities.

• Reports on regulatory actions.

• Adequacy of support for any planned disposals of assets.

Also consider the impact of any additional facts or information since the date

management made its assessment and plans.

Obtaining Written Request written representations from management (and those charged with

Confi rmations governance) regarding their plans for future action and feasibility.

168