Page 175 - Internal Auditing Standards

P. 175

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

Non-compliance by the entity with laws and regulations could result in a material misstatement of the

fi nancial statements.

The responsibility for the prevention and detection of non-compliance with laws and regulations rests with

management and those charged with governance. Management actions to address these risks could include:

• Maintaining a register of significant laws, and a record of any complaints received;

• Monitoring legal requirements and designing procedures/internal controls to ensure compliance with

these requirements;

• Engaging legal advisors to assist in monitoring legal requirements; and

• Developing, publicizing, implementing, and following a code of conduct.

When the auditor detects instances of non-compliance, the impact on the financial statements and other

aspects of the audit (such as the integrity of management/employees) will need to be considered.

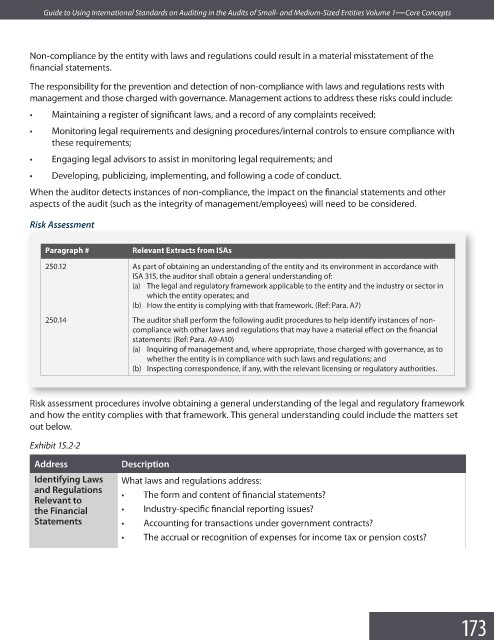

Risk Assessment

Paragraph # Relevant Extracts from ISAs

250.12 As part of obtaining an understanding of the entity and its environment in accordance with

ISA 315, the auditor shall obtain a general understanding of:

(a) The legal and regulatory framework applicable to the entity and the industry or sector in

which the entity operates; and

(b) How the entity is complying with that framework. (Ref: Para. A7)

250.14 The auditor shall perform the following audit procedures to help identify instances of non-

compliance with other laws and regulations that may have a material effect on the fi nancial

statements: (Ref: Para. A9-A10)

(a) Inquiring of management and, where appropriate, those charged with governance, as to

whether the entity is in compliance with such laws and regulations; and

(b) Inspecting correspondence, if any, with the relevant licensing or regulatory authorities.

Risk assessment procedures involve obtaining a general understanding of the legal and regulatory framework

and how the entity complies with that framework. This general understanding could include the matters set

out below.

Exhibit 15.2-2

Address Description

Identifying Laws What laws and regulations address:

and Regulations

Relevant to • The form and content of fi nancial statements?

the Financial • Industry-specifi c financial reporting issues?

Statements • Accounting for transactions under government contracts?

• The accrual or recognition of expenses for income tax or pension costs?

173