Page 180 - Internal Auditing Standards

P. 180

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

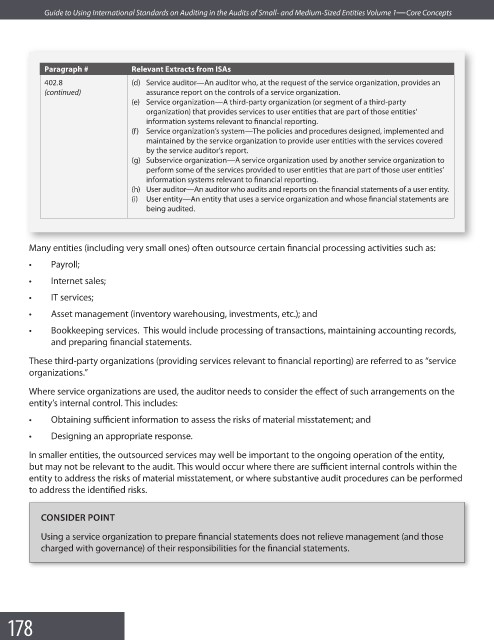

Paragraph # Relevant Extracts from ISAs

402.8 (d) Service auditor—An auditor who, at the request of the service organization, provides an

(continued) assurance report on the controls of a service organization.

(e) Service organization—A third-party organization (or segment of a third-party

organization) that provides services to user entities that are part of those entities’

information systems relevant to fi nancial reporting.

(f) Service organization’s system—The policies and procedures designed, implemented and

maintained by the service organization to provide user entities with the services covered

by the service auditor’s report.

(g) Subservice organization—A service organization used by another service organization to

perform some of the services provided to user entities that are part of those user entities’

information systems relevant to fi nancial reporting.

(h) User auditor—An auditor who audits and reports on the financial statements of a user entity.

(i) User entity—An entity that uses a service organization and whose financial statements are

being audited.

Many entities (including very small ones) often outsource certain financial processing activities such as:

• Payroll;

• Internet sales;

• IT services;

• Asset management (inventory warehousing, investments, etc.); and

• Bookkeeping services. This would include processing of transactions, maintaining accounting records,

and preparing financial statements.

These third-party organizations (providing services relevant to financial reporting) are referred to as “service

organizations.”

Where service organizations are used, the auditor needs to consider the effect of such arrangements on the

entity’s internal control. This includes:

• Obtaining sufficient information to assess the risks of material misstatement; and

• Designing an appropriate response.

In smaller entities, the outsourced services may well be important to the ongoing operation of the entity,

but may not be relevant to the audit. This would occur where there are sufficient internal controls within the

entity to address the risks of material misstatement, or where substantive audit procedures can be performed

to address the identifi ed risks.

CONSIDER POINT

Using a service organization to prepare financial statements does not relieve management (and those

charged with governance) of their responsibilities for the fi nancial statements.

178