Page 176 - Internal Auditing Standards

P. 176

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

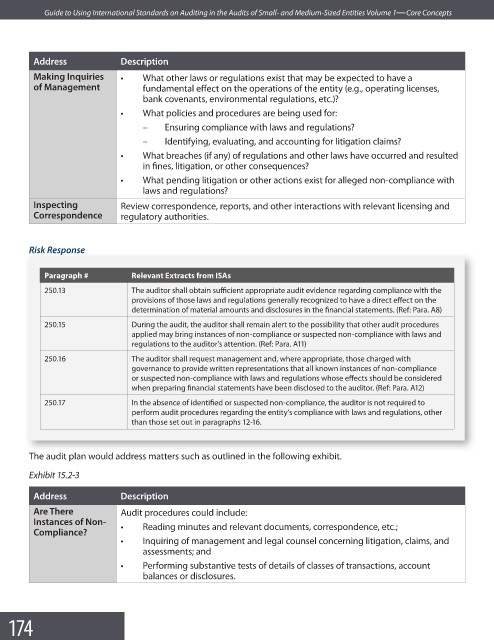

Address Description

Making Inquiries • What other laws or regulations exist that may be expected to have a

of Management fundamental effect on the operations of the entity (e.g., operating licenses,

bank covenants, environmental regulations, etc.)?

• What policies and procedures are being used for:

– Ensuring compliance with laws and regulations?

– Identifying, evaluating, and accounting for litigation claims?

• What breaches (if any) of regulations and other laws have occurred and resulted

in fines, litigation, or other consequences?

• What pending litigation or other actions exist for alleged non-compliance with

laws and regulations?

Inspecting Review correspondence, reports, and other interactions with relevant licensing and

Correspondence regulatory authorities.

ons

Resp

e

Ris

Risk Response

k

Paragraph # Relevant Extracts from ISAs

250.13 The auditor shall obtain sufficient appropriate audit evidence regarding compliance with the

provisions of those laws and regulations generally recognized to have a direct effect on the

determination of material amounts and disclosures in the financial statements. (Ref: Para. A8)

250.15 During the audit, the auditor shall remain alert to the possibility that other audit procedures

applied may bring instances of non-compliance or suspected non-compliance with laws and

regulations to the auditor’s attention. (Ref: Para. A11)

250.16 The auditor shall request management and, where appropriate, those charged with

governance to provide written representations that all known instances of non-compliance

or suspected non-compliance with laws and regulations whose effects should be considered

when preparing financial statements have been disclosed to the auditor. (Ref: Para. A12)

250.17 In the absence of identified or suspected non-compliance, the auditor is not required to

perform audit procedures regarding the entity’s compliance with laws and regulations, other

than those set out in paragraphs 12-16.

The audit plan would address matters such as outlined in the following exhibit.

Exhibit 15.2-3

Address Description

Are There Audit procedures could include:

Instances of Non- • Reading minutes and relevant documents, correspondence, etc.;

Compliance?

• Inquiring of management and legal counsel concerning litigation, claims, and

assessments; and

• Performing substantive tests of details of classes of transactions, account

balances or disclosures.

174