Page 174 - Internal Auditing Standards

P. 174

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

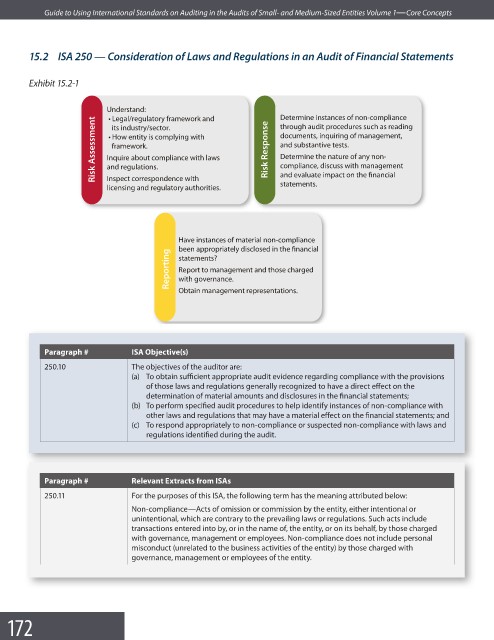

15.2 ISA 250 — Consideration of Laws and Regulations in an Audit of Financial Statements

Exhibit 15.2-1

Understand: Determine instances of non-compliance

t Legal/regulatory framework and

Risk Assessment and regulations. Risk Response documents, inquiring of management,

through audit procedures such as reading

its industry/sector.

t How entity is complying with

and substantive tests.

framework.

Determine the nature of any non-

Inquire about compliance with laws

compliance, discuss with management

Inspect correspondence with

statements.

licensing and regulatory authorities. and evaluate impact on the financial

Have instances of material non-compliance

been appropriately disclosed in the financial

Reporting Report to management and those charged

statements?

with governance.

Obtain management representations.

Paragraph # ISA Objective(s)

250.10 The objectives of the auditor are:

(a) To obtain sufficient appropriate audit evidence regarding compliance with the provisions

of those laws and regulations generally recognized to have a direct effect on the

determination of material amounts and disclosures in the fi nancial statements;

(b) To perform specified audit procedures to help identify instances of non-compliance with

other laws and regulations that may have a material effect on the financial statements; and

(c) To respond appropriately to non-compliance or suspected non-compliance with laws and

regulations identified during the audit.

Paragraph # Relevant Extracts from ISAs

250.11 For the purposes of this ISA, the following term has the meaning attributed below:

Non-compliance—Acts of omission or commission by the entity, either intentional or

unintentional, which are contrary to the prevailing laws or regulations. Such acts include

transactions entered into by, or in the name of, the entity, or on its behalf, by those charged

with governance, management or employees. Non-compliance does not include personal

misconduct (unrelated to the business activities of the entity) by those charged with

governance, management or employees of the entity.

172