Page 184 - Internal Auditing Standards

P. 184

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

Paragraph # Relevant Extracts from ISAs

402.19 The user auditor shall inquire of management of the user entity whether the service

organization has reported to the user entity, or whether the user entity is otherwise aware of,

any fraud, non-compliance with laws and regulations or uncorrected misstatements aff ecting

the financial statements of the user entity. The user auditor shall evaluate how such matters

affect the nature, timing and extent of the user auditor’s further audit procedures, including

the effect on the user auditor’s conclusions and user auditor’s report. (Ref: Para. A41)

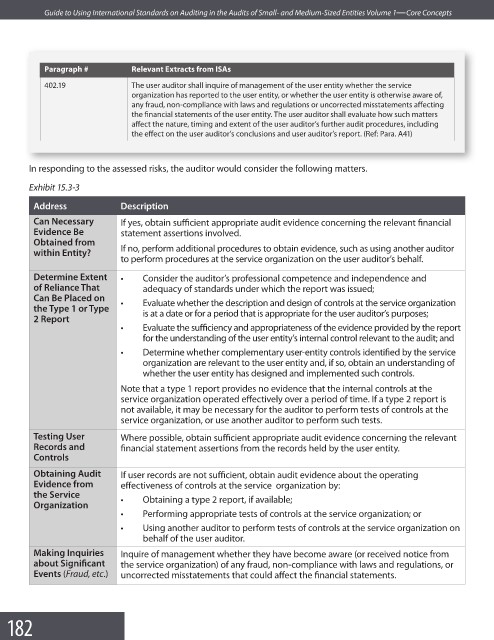

In responding to the assessed risks, the auditor would consider the following matters.

Exhibit 15.3-3

Address Description

Can Necessary If yes, obtain sufficient appropriate audit evidence concerning the relevant fi nancial

Evidence Be statement assertions involved.

Obtained from

within Entity? If no, perform additional procedures to obtain evidence, such as using another auditor

to perform procedures at the service organization on the user auditor’s behalf.

Determine Extent • Consider the auditor’s professional competence and independence and

of Reliance That adequacy of standards under which the report was issued;

Can Be Placed on • Evaluate whether the description and design of controls at the service organization

the Type 1 or Type is at a date or for a period that is appropriate for the user auditor’s purposes;

2 Report

• Evaluate the sufficiency and appropriateness of the evidence provided by the report

for the understanding of the user entity’s internal control relevant to the audit; and

• Determine whether complementary user-entity controls identified by the service

organization are relevant to the user entity and, if so, obtain an understanding of

whether the user entity has designed and implemented such controls.

Note that a type 1 report provides no evidence that the internal controls at the

service organization operated effectively over a period of time. If a type 2 report is

not available, it may be necessary for the auditor to perform tests of controls at the

service organization, or use another auditor to perform such tests.

Testing User Where possible, obtain sufficient appropriate audit evidence concerning the relevant

Records and financial statement assertions from the records held by the user entity.

Controls

Obtaining Audit If user records are not sufficient, obtain audit evidence about the operating

Evidence from effectiveness of controls at the service organization by:

the Service

Organization • Obtaining a type 2 report, if available;

• Performing appropriate tests of controls at the service organization; or

• Using another auditor to perform tests of controls at the service organization on

behalf of the user auditor.

Making Inquiries Inquire of management whether they have become aware (or received notice from

about Signifi cant the service organization) of any fraud, non-compliance with laws and regulations, or

Events (Fraud, etc.) uncorrected misstatements that could affect the fi nancial statements.

182