Page 188 - Internal Auditing Standards

P. 188

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

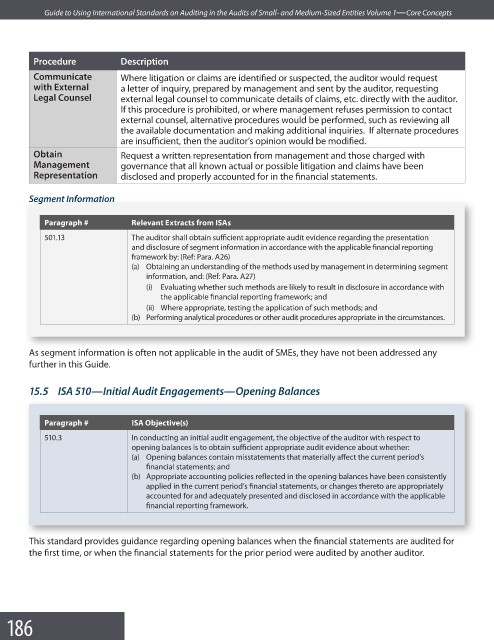

Procedure Description

Communicate Where litigation or claims are identified or suspected, the auditor would request

with External a letter of inquiry, prepared by management and sent by the auditor, requesting

Legal Counsel external legal counsel to communicate details of claims, etc. directly with the auditor.

If this procedure is prohibited, or where management refuses permission to contact

external counsel, alternative procedures would be performed, such as reviewing all

the available documentation and making additional inquiries. If alternate procedures

are insufficient, then the auditor’s opinion would be modifi ed.

Obtain Request a written representation from management and those charged with

Management governance that all known actual or possible litigation and claims have been

Representation disclosed and properly accounted for in the fi nancial statements.

Segment Information

Se g m e n t Infor m at ion

Paragraph # Relevant Extracts from ISAs

501.13 The auditor shall obtain sufficient appropriate audit evidence regarding the presentation

and disclosure of segment information in accordance with the applicable fi nancial reporting

framework by: (Ref: Para. A26)

(a) Obtaining an understanding of the methods used by management in determining segment

information, and: (Ref: Para. A27)

(i) Evaluating whether such methods are likely to result in disclosure in accordance with

the applicable financial reporting framework; and

(ii) Where appropriate, testing the application of such methods; and

(b) Performing analytical procedures or other audit procedures appropriate in the circumstances.

As segment information is often not applicable in the audit of SMEs, they have not been addressed any

further in this Guide.

15.5 ISA 510—Initial Audit Engagements—Opening Balances

Paragraph # ISA Objective(s)

510.3 In conducting an initial audit engagement, the objective of the auditor with respect to

opening balances is to obtain sufficient appropriate audit evidence about whether:

(a) Opening balances contain misstatements that materially affect the current period’s

financial statements; and

(b) Appropriate accounting policies reflected in the opening balances have been consistently

applied in the current period’s financial statements, or changes thereto are appropriately

accounted for and adequately presented and disclosed in accordance with the applicable

financial reporting framework.

This standard provides guidance regarding opening balances when the financial statements are audited for

the first time, or when the financial statements for the prior period were audited by another auditor.

186