Page 190 - Internal Auditing Standards

P. 190

Guide to Using International Standards on Auditing in the Audits of Small- and Medium-Sized Entities Volume 1—Core Concepts

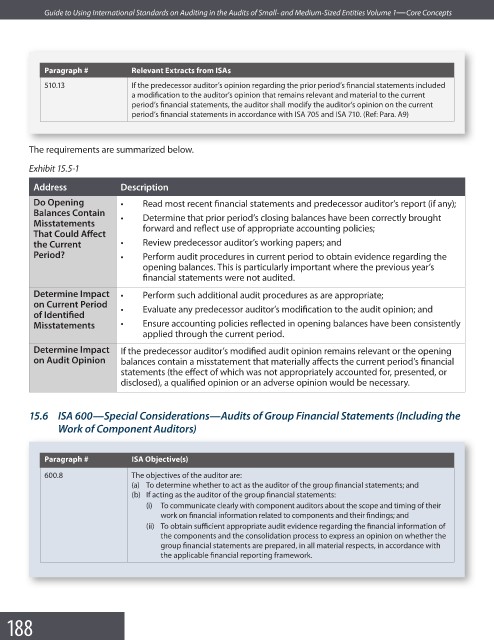

Paragraph # Relevant Extracts from ISAs

510.13 If the predecessor auditor’s opinion regarding the prior period’s financial statements included

a modification to the auditor’s opinion that remains relevant and material to the current

period’s financial statements, the auditor shall modify the auditor’s opinion on the current

period’s financial statements in accordance with ISA 705 and ISA 710. (Ref: Para. A9)

The requirements are summarized below.

Exhibit 15.5-1

Address Description

Do Opening • Read most recent financial statements and predecessor auditor’s report (if any);

Balances Contain

• Determine that prior period’s closing balances have been correctly brought

Misstatements forward and reflect use of appropriate accounting policies;

That Could Aff ect

the Current • Review predecessor auditor’s working papers; and

Period? • Perform audit procedures in current period to obtain evidence regarding the

opening balances. This is particularly important where the previous year’s

financial statements were not audited.

Determine Impact • Perform such additional audit procedures as are appropriate;

on Current Period Evaluate any predecessor auditor’s modification to the audit opinion; and

of Identifi ed •

Misstatements • Ensure accounting policies reflected in opening balances have been consistently

applied through the current period.

Determine Impact If the predecessor auditor’s modifi ed audit opinion remains relevant or the opening

on Audit Opinion balances contain a misstatement that materially affects the current period’s fi nancial

statements (the effect of which was not appropriately accounted for, presented, or

disclosed), a qualified opinion or an adverse opinion would be necessary.

15.6 ISA 600—Special Considerations—Audits of Group Financial Statements (Including the

Work of Component Auditors)

Paragraph # ISA Objective(s)

600.8 The objectives of the auditor are:

(a) To determine whether to act as the auditor of the group financial statements; and

(b) If acting as the auditor of the group fi nancial statements:

(i) To communicate clearly with component auditors about the scope and timing of their

work on financial information related to components and their fi ndings; and

(ii) To obtain sufficient appropriate audit evidence regarding the financial information of

the components and the consolidation process to express an opinion on whether the

group financial statements are prepared, in all material respects, in accordance with

the applicable financial reporting framework.

188