Page 188 - Individual Forms & Instructions Guide

P. 188

Userid: CPM

Draft

Ok to Print

i1040x

AH XSL/XML Fileid: … /i1040schc/2022/a/xml/cycle07/source

Page 1 of 20

13:32 - 25-Jan-2023

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury Schema: Leadpct: 100% Pt. size: 10 (Init. & Date) _______

Internal Revenue Service

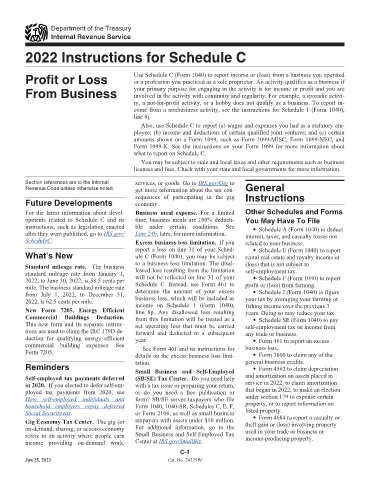

2022 Instructions for Schedule C

Profit or Loss Use Schedule C (Form 1040) to report income or (loss) from a business you operated

or a profession you practiced as a sole proprietor. An activity qualifies as a business if

From Business your primary purpose for engaging in the activity is for income or profit and you are

involved in the activity with continuity and regularity. For example, a sporadic activi-

ty, a not-for-profit activity, or a hobby does not qualify as a business. To report in-

come from a nonbusiness activity, see the instructions for Schedule 1 (Form 1040),

line 8j.

Also, use Schedule C to report (a) wages and expenses you had as a statutory em-

ployee; (b) income and deductions of certain qualified joint ventures; and (c) certain

amounts shown on a Form 1099, such as Form 1099-MISC, Form 1099-NEC, and

Form 1099-K. See the instructions on your Form 1099 for more information about

what to report on Schedule C.

You may be subject to state and local taxes and other requirements such as business

licenses and fees. Check with your state and local governments for more information.

Section references are to the Internal services, or goods. Go to IRS.gov/Gig to

Revenue Code unless otherwise noted. get more information about the tax con- General

Future Developments sequences of participating in the gig Instructions

economy.

For the latest information about devel- Business meal expense. For a limited Other Schedules and Forms

opments related to Schedule C and its time, business meals are 100% deducti- You May Have To File

instructions, such as legislation enacted ble under certain conditions. See • Schedule A (Form 1040) to deduct

after they were published, go to IRS.gov/ Line 24b, later, for more information. interest, taxes, and casualty losses not

ScheduleC. Excess business loss limitation. If you related to your business.

• Schedule E (Form 1040) to report

What's New report a loss on line 31 of your Sched- rental real estate and royalty income or

ule C (Form 1040), you may be subject

to a business loss limitation. The disal- (loss) that is not subject to

Standard mileage rate. The business lowed loss resulting from the limitation

standard mileage rate from January 1, self-employment tax.

2022, to June 30, 2022, is 58.5 cents per will not be reflected on line 31 of your • Schedule F (Form 1040) to report

Schedule C. Instead, use Form 461 to

mile. The business standard mileage rate profit or (loss) from farming.

from July 1, 2022, to December 31, determine the amount of your excess • Schedule J (Form 1040) to figure

business loss, which will be included as

2022, is 62.5 cents per mile. income on Schedule 1 (Form 1040), your tax by averaging your farming or

fishing income over the previous 3

New Form 7205, Energy Efficient line 8p. Any disallowed loss resulting years. Doing so may reduce your tax.

Commercial Buildings Deduction. from this limitation will be treated as a

• Schedule SE (Form 1040) to pay

This new form and its separate instruc- net operating loss that must be carried self-employment tax on income from

tions are used to claim the IRC 179D de- forward and deducted in a subsequent any trade or business.

duction for qualifying energy efficient year. • Form 461 to report an excess

commercial building expenses. See business loss.

Form 7205. See Form 461 and its instructions for

details on the excess business loss limi- • Form 3800 to claim any of the

Reminders tation. general business credits.

Small Business and Self-Employed • Form 4562 to claim depreciation

Self-employed tax payments deferred (SB/SE) Tax Center. Do you need help and amortization on assets placed in

in 2020. If you elected to defer self-em- with a tax issue or preparing your return, service in 2022, to claim amortization

ployed tax payments from 2020, see or do you need a free publication or that began in 2022, to make an election

How self-employed individuals and form? SB/SE serves taxpayers who file under section 179 to expense certain

household employers repay deferred Form 1040, 1040-SR, Schedules C, E, F, property, or to report information on

Social Security tax. or Form 2106, as well as small business listed property.

• Form 4684 to report a casualty or

Gig Economy Tax Center. The gig (or taxpayers with assets under $10 million. theft gain or (loss) involving property

on-demand, sharing, or access) economy For additional information, go to the used in your trade or business or

refers to an activity where people earn Small Business and Self-Employed Tax income-producing property.

income providing on-demand work, Center at IRS.gov/SmallBiz.

C-1

Jan 25, 2023 Cat. No. 24329W