Page 53 - Tax Guide for Small Business

P. 53

12:18 - 30-Jan-2020

Page 51 of 54

Fileid: … tions/P334/2019/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

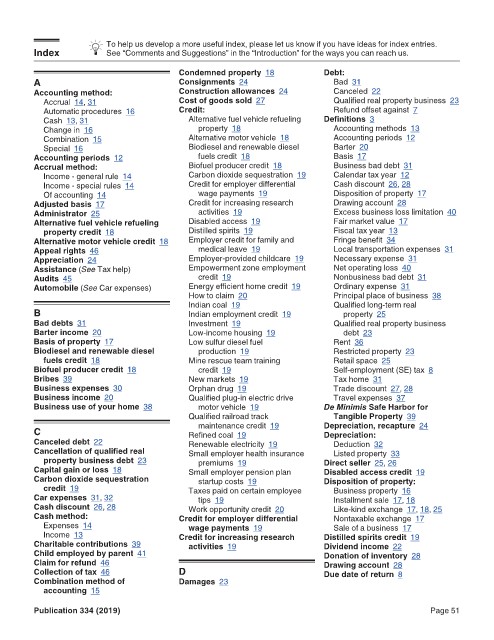

To help us develop a more useful index, please let us know if you have ideas for index entries.

Index See “Comments and Suggestions” in the “Introduction” for the ways you can reach us.

Condemned property 18 Debt:

A Consignments 24 Bad 31

Accounting method: Construction allowances 24 Canceled 22

Accrual 14, 31 Cost of goods sold 27 Qualified real property business 23

Automatic procedures 16 Credit: Refund offset against 7

Cash 13, 31 Alternative fuel vehicle refueling Definitions 3

Change in 16 property 18 Accounting methods 13

Combination 15 Alternative motor vehicle 18 Accounting periods 12

Special 16 Biodiesel and renewable diesel Barter 20

Accounting periods 12 fuels credit 18 Basis 17

Accrual method: Biofuel producer credit 18 Business bad debt 31

Income - general rule 14 Carbon dioxide sequestration 19 Calendar tax year 12

Income - special rules 14 Credit for employer differential Cash discount 26, 28

Of accounting 14 wage payments 19 Disposition of property 17

Adjusted basis 17 Credit for increasing research Drawing account 28

Administrator 25 activities 19 Excess business loss limitation 40

Alternative fuel vehicle refueling Disabled access 19 Fair market value 17

property credit 18 Distilled spirits 19 Fiscal tax year 13

Alternative motor vehicle credit 18 Employer credit for family and Fringe benefit 34

Appeal rights 46 medical leave 19 Local transportation expenses 31

Appreciation 24 Employer-provided childcare 19 Necessary expense 31

Assistance (See Tax help) Empowerment zone employment Net operating loss 40

Audits 45 credit 19 Nonbusiness bad debt 31

Automobile (See Car expenses) Energy efficient home credit 19 Ordinary expense 31

How to claim 20 Principal place of business 38

Indian coal 19 Qualified long-term real

B Indian employment credit 19 property 25

Bad debts 31 Investment 19 Qualified real property business

Barter income 20 Low-income housing 19 debt 23

Basis of property 17 Low sulfur diesel fuel Rent 36

Biodiesel and renewable diesel production 19 Restricted property 23

fuels credit 18 Mine rescue team training Retail space 25

Biofuel producer credit 18 credit 19 Self-employment (SE) tax 8

Bribes 39 New markets 19 Tax home 31

Business expenses 30 Orphan drug 19 Trade discount 27, 28

Business income 20 Qualified plug-in electric drive Travel expenses 37

Business use of your home 38 motor vehicle 19 De Minimis Safe Harbor for

Qualified railroad track Tangible Property 39

maintenance credit 19

C Refined coal 19 Depreciation, recapture 24

Depreciation:

Canceled debt 22 Renewable electricity 19 Deduction 32

Cancellation of qualified real Small employer health insurance Listed property 33

property business debt 23 premiums 19 Direct seller 25, 26

Capital gain or loss 18 Small employer pension plan Disabled access credit 19

Carbon dioxide sequestration startup costs 19 Disposition of property:

credit 19 Taxes paid on certain employee Business property 16

Car expenses 31, 32 tips 19 Installment sale 17, 18

Cash discount 26, 28 Work opportunity credit 20 Like-kind exchange 17, 18, 25

Cash method: Credit for employer differential Nontaxable exchange 17

Expenses 14 wage payments 19 Sale of a business 17

Income 13 Credit for increasing research Distilled spirits credit 19

Charitable contributions 39 activities 19 Dividend income 22

Child employed by parent 41 Donation of inventory 28

Claim for refund 46 Drawing account 28

Collection of tax 46 D Due date of return 8

Combination method of Damages 23

accounting 15

Publication 334 (2019) Page 51