Page 55 - Tax Guide for Small Business

P. 55

Page 53 of 54

Fileid: … tions/P334/2019/A/XML/Cycle03/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

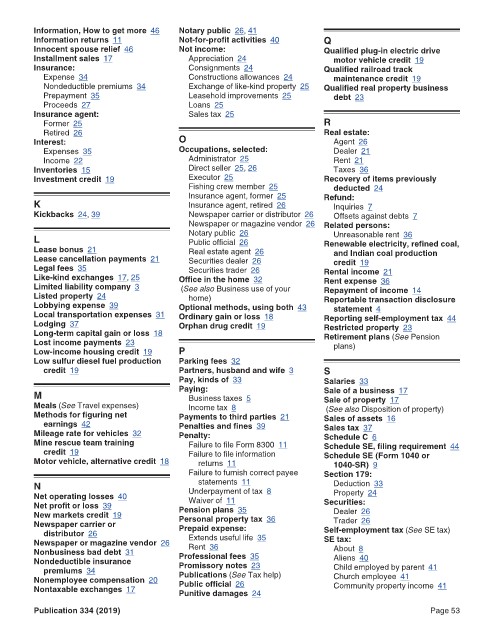

Information, How to get more 46 Notary public 26, 41 12:18 - 30-Jan-2020

Information returns 11 Not-for-profit activities 40 Q

Innocent spouse relief 46 Not income: Qualified plug-in electric drive

Installment sales 17 Appreciation 24 motor vehicle credit 19

Insurance: Consignments 24 Qualified railroad track

Expense 34 Constructions allowances 24 maintenance credit 19

Nondeductible premiums 34 Exchange of like-kind property 25 Qualified real property business

Prepayment 35 Leasehold improvements 25 debt 23

Proceeds 27 Loans 25

Insurance agent: Sales tax 25

Former 25 R

Retired 26 Real estate:

Interest: O Agent 26

Expenses 35 Occupations, selected: Dealer 21

Income 22 Administrator 25 Rent 21

Inventories 15 Direct seller 25, 26 Taxes 36

Investment credit 19 Executor 25 Recovery of items previously

Fishing crew member 25 deducted 24

Insurance agent, former 25 Refund:

K Insurance agent, retired 26 Inquiries 7

Kickbacks 24, 39 Newspaper carrier or distributor 26 Offsets against debts 7

Newspaper or magazine vendor 26 Related persons:

Unreasonable rent 36

L Notary public 26 Renewable electricity, refined coal,

Public official 26

Lease bonus 21 Real estate agent 26 and Indian coal production

Lease cancellation payments 21 Securities dealer 26 credit 19

Legal fees 35 Securities trader 26 Rental income 21

Like-kind exchanges 17, 25 Office in the home 32 Rent expense 36

Limited liability company 3 (See also Business use of your Repayment of income 14

Listed property 24 home) Reportable transaction disclosure

Lobbying expense 39 Optional methods, using both 43 statement 4

Local transportation expenses 31 Ordinary gain or loss 18 Reporting self-employment tax 44

Lodging 37 Orphan drug credit 19 Restricted property 23

Long-term capital gain or loss 18 Retirement plans (See Pension

Lost income payments 23 plans)

Low-income housing credit 19 P

Low sulfur diesel fuel production Parking fees 32

credit 19 Partners, husband and wife 3 S

Pay, kinds of 33 Salaries 33

M Paying: Sale of a business 17

Business taxes 5

Sale of property 17

Meals (See Travel expenses) Income tax 8 (See also Disposition of property)

Methods for figuring net Payments to third parties 21 Sales of assets 16

earnings 42 Penalties and fines 39 Sales tax 37

Mileage rate for vehicles 32 Penalty: Schedule C 6

Mine rescue team training Failure to file Form 8300 11 Schedule SE, filing requirement 44

credit 19 Failure to file information Schedule SE (Form 1040 or

Motor vehicle, alternative credit 18 returns 11 1040-SR) 9

Failure to furnish correct payee Section 179:

statements 11

N Underpayment of tax 8 Deduction 33

Net operating losses 40 Waiver of 11 Property 24

Net profit or loss 39 Pension plans 35 Securities:

New markets credit 19 Personal property tax 36 Dealer 26

Newspaper carrier or Prepaid expense: Trader 26

distributor 26 Extends useful life 35 Self-employment tax (See SE tax)

Newspaper or magazine vendor 26 Rent 36 SE tax:

Nonbusiness bad debt 31 Professional fees 35 About 8

Nondeductible insurance Promissory notes 23 Aliens 40

premiums 34 Publications (See Tax help) Child employed by parent 41

Nonemployee compensation 20 Public official 26 Church employee 41

Nontaxable exchanges 17 Punitive damages 24 Community property income 41

Publication 334 (2019) Page 53