Page 8 - IRS Individual Tax Forms

P. 8

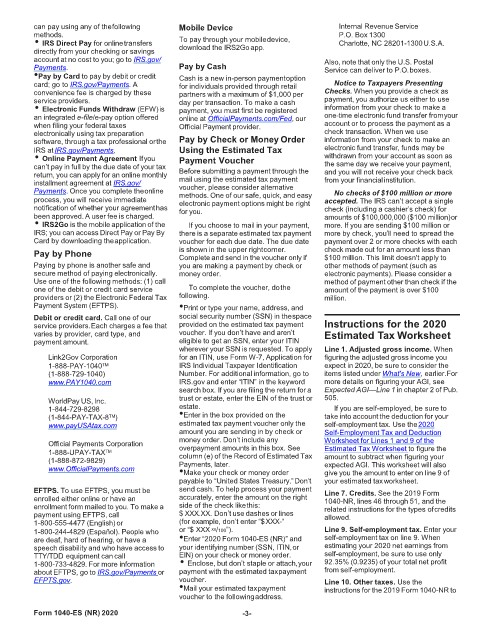

can pay using any of thefollowing Mobile Device Internal Revenue Service

methods. P.O. Box 1300

• IRS Direct Pay for onlinetransfers To pay through your mobiledevice, Charlotte, NC 28201-1300U.S.A.

directly from your checking or savings download the IRS2Go app.

account at no cost to you; go to IRS.gov/ Also, note that only the U.S. Postal

Payments. Pay by Cash Service can deliver to P.O.boxes.

•Pay by Card to pay by debit or credit Cash is a new in-person paymentoption

card; go to IRS.gov/Payments. A for individuals provided through retail Notice to Taxpayers Presenting

convenience fee is charged by these partners with a maximum of $1,000 per Checks. When you provide a check as

service providers. day per transaction. To make a cash payment, you authorize us either to use

• Electronic Funds Withdraw (EFW)is payment, you must first be registered information from your check to make a

an integrated e-file/e-pay option offered online at OfficialPayments.com/Fed, our one-time electronic fund transfer fromyour

when filing your federal taxes Official Payment provider. account or to process the payment as a

electronically using tax preparation check transaction. When we use

software, through a tax professional orthe Pay by Check or Money Order information from your check to make an

IRS atIRS.gov/Payments. Using the Estimated Tax electronic fund transfer, funds may be

• Online Payment Agreement Ifyou Payment Voucher withdrawn from your account as soon as

can’t pay in full by the due date of your tax the same day we receive your payment,

return, you can apply for an online monthly Before submitting a payment through the and you will not receive your check back

installment agreement at IRS.gov/ mail using the estimated tax payment from your financialinstitution.

Payments. Once you complete theonline voucher, please consider alternative No checks of $100 million or more

process, you will receive immediate methods. One of our safe, quick, and easy accepted. The IRS can’t accept a single

electronic payment options might be right

notification of whether your agreementhas for you. check (including a cashier’s check) for

been approved. A user fee is charged. amounts of $100,000,000 ($100 million)or

• IRS2Go is the mobile application of the If you choose to mail in your payment, more. If you are sending $100 million or

IRS; you can access Direct Pay or Pay By there is a separate estimated tax payment more by check, you’ll need to spread the

Card by downloading theapplication. voucher for each due date. The due date payment over 2 or more checks with each

Pay by Phone is shown in the upper rightcorner. check made out for an amount less than

Complete and send in the voucher only if

$100 million. This limit doesn't apply to

Paying by phone is another safe and you are making a payment by check or other methods of payment (such as

secure method of paying electronically. money order. electronic payments). Please consider a

Use one of the following methods: (1) call method of payment other than check if the

one of the debit or credit card service To complete the voucher, dothe amount of the payment is over $100

providers or (2) the Electronic Federal Tax following. million.

Payment System (EFTPS). •Print or type your name, address, and

Debit or credit card. Call one of our social security number (SSN) in thespace

service providers.Each charges a fee that provided on the estimated tax payment Instructions for the 2020

varies by provider, card type, and voucher. If you don’t have and aren’t Estimated Tax Worksheet

payment amount. eligible to get an SSN, enter your ITIN

wherever your SSN is requested. To apply Line 1. Adjusted gross income. When

Link2Gov Corporation for an ITIN, use Form W-7, Application for figuring the adjusted gross income you

1-888-PAY-1040 TM IRS Individual Taxpayer Identification expect in 2020, be sure to consider the

(1-888-729-1040) Number. For additional information, go to items listed under What's New, earlier.For

www.PAY1040.com IRS.gov and enter “ITIN” in the keyword more details on figuring your AGI, see

search box. If you are filing the return for a Expected AGI—Line 1 in chapter 2 of Pub.

WorldPay US,Inc. trust or estate, enter the EIN of the trust or 505.

1-844-729-8298 estate. If you are self-employed, be sure to

(1-844-PAY-TAX-8 ) •Enter in the box provided on the take into account the deduction for your

TM

www.payUSAtax.com estimated tax payment voucher only the self-employment tax. Use the2020

amount you are sending in by check or Self-Employment Tax and Deduction

money order. Don’t include any Worksheet for Lines 1 and 9 of the

Official Payments Corporation overpayment amounts in this box. See

1-888-UPAY-TAX TM column (e) of the Record of Estimated Tax Estimated Tax Worksheet to figure the

amount to subtract when figuring your

(1-888-872-9829) Payments, later. expected AGI. This worksheet will also

www.OfficialPayments.com

•Make your check or money order give you the amount to enter on line 9 of

payable to “United States Treasury.”Don’t your estimated taxworksheet.

EFTPS. To use EFTPS, you must be send cash. To help process your payment Line 7. Credits. See the 2019 Form

enrolled either online or have an accurately, enter the amount on the right 1040-NR, lines 46 through 51, and the

enrollment form mailed to you. To make a side of the check likethis: related instructions for the types ofcredits

payment using EFTPS, call $ XXX.XX. Don’t use dashes or lines allowed.

1-800-555-4477 (English) or (for example, don’t enter “$XXX-”

1-800-244-4829 (Español). People who or “$ XXX xx /100”). Line 9. Self-employment tax. Enter your

are deaf, hard of hearing, or have a •Enter “2020 Form 1040-ES (NR)” and self-employment tax on line 9. When

speech disability and who have access to your identifying number (SSN, ITIN,or estimating your 2020 net earnings from

TTY/TDD equipment can call EIN) on your check or money order. self-employment, be sure to use only

1-800-733-4829. For more information • Enclose, but don’t staple or attach,your 92.35% (0.9235) of your total net profit

about EFTPS, go to IRS.gov/Payments or payment with the estimated taxpayment from self-employment.

EFPTS.gov. voucher. Line 10. Other taxes. Use the

•Mail your estimated taxpayment instructions for the 2019 Form 1040-NR to

voucher to the followingaddress.

Form 1040-ES (NR) 2020 -3-