Page 483 - ITGC_Audit Guides

P. 483

GTAG — Implementing Continuous Auditing

categorization or misleading comments entered by an Following are examples of continuous auditing techniques

employee could go undetected. The effectiveness of the that were used to identify control deficiencies, anomalies,

rules-based system was dependent upon: and red flags indicating potential fraud and abuse. Although

not quantified here, internal auditors reportedly reduced

• The accuracy and honesty of the employee entering the hours previously needed to acquire data, perform data

the expense item. analysis, and vet and review results, compared to previous

• The willingness and ability of managers to accurately electronic expense system audits.

review and approve or deny the expense timely.

Questionable Spending Metrics

Faced with these challenges, the internal auditors tried Identification of all questionable spending summarized by

to find the best way to test the validity of expense merchant code, employee, and establishment.

transactions.

Questionable Spending at Restricted Establishments

The Continuous Auditing Solution Identification of all expense activity for restricted

In summary, internal auditors determined: establishments billed back as an employee expense.

Restricted establishments were identified by indicators

1. Credit card transaction detail was available from the card such as legal supplier names, address match, sites with a

issuer, and comparing the electronic expense system data mix of expensed and personal activity, split high dollar

with the card issuer’s data could provide a better picture transactions, and restricted keywords (e.g., kids, hospital,

of the validity of the expenses. nightclub, gentleman, casino, premium, and upgrade).

2. Once the card issuer report data was matched with Incorrect Categorization Summary

the electronic expense system data by employee Identification of all non-meal expenses (e.g., clothing

number, charge date, and charge amount, the expense expense) incorrectly categorized as a meal or entertainment.

categorization and comments could be compared to the

transaction merchant code and transaction description.

For example, a transaction with a merchant code for a

shoe store, but categorized in the expense record as a

meal, could be identified.

3. The card issuer provided “questionable reports” that

could be customized to target specific merchant classes

and run on a monthly or quarterly schedule.

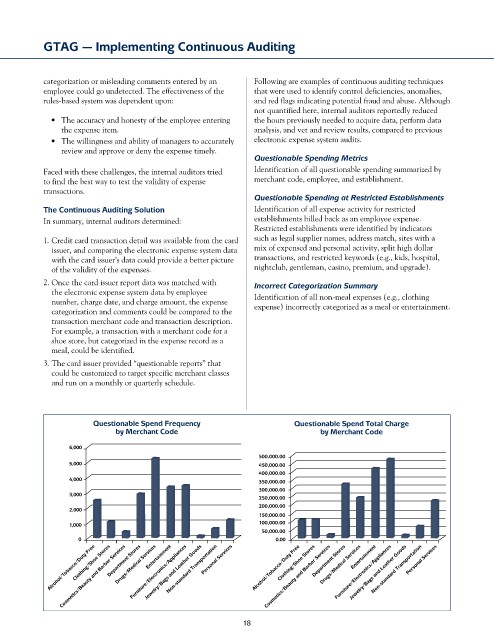

Questionable Spend Frequency Questionable Spend Total Charge

by Merchant Code by Merchant Code

6,000

500,000.00

5,000 450,000.00

400,000.00

4,000 350,000.00

300,000.00

3,000

250,000.00

200,000.00

2,000

150,000.00

1,000 100,000.00

50,000.00

0 0.00

Alcohol/Tobacco/Duty Free Department Stores Jewelry/Bags and Leather Goods Personal Services Alcohol/Tobacco/Duty Free Department Stores Jewelry/Bags and Leather Goods Personal Services

Furniture/Electronics/Appliances

Drugs/Medical Services

Clothing/Shoe Stores

Entertainment

Cosmetics/Beauty and Barber Services

Non-standard Transportation

Furniture/Electronics/Appliances

Entertainment

Non-standard Transportation

Drugs/Medical Services

Cosmetics/Beauty and Barber Services

Clothing/Shoe Stores

18