Page 41 - IRS Employer Tax Forms

P. 41

• Indian employment credit. renew it. For more information, see the Instructionsfor

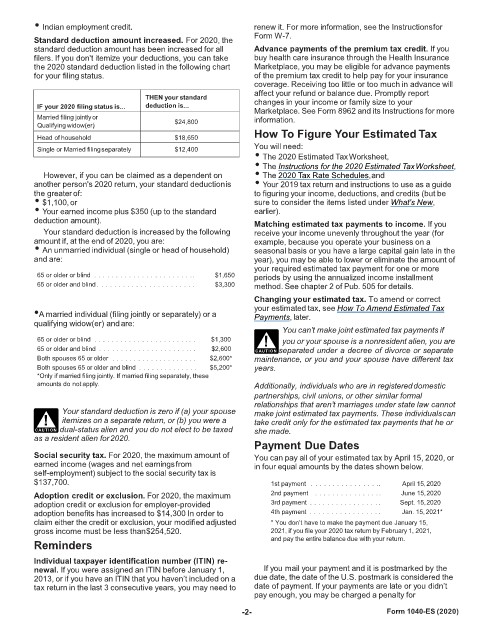

Standard deduction amount increased. For 2020, the Form W-7.

standard deduction amount has been increased for all Advance payments of the premium tax credit. If you

filers. If you don't itemize your deductions, you can take buy health care insurance through the Health Insurance

the 2020 standard deduction listed in the following chart Marketplace, you may be eligible for advance payments

for your filing status. of the premium tax credit to help pay for your insurance

coverage. Receiving too little or too much in advance will

affect your refund or balance due. Promptly report

THEN your standard

IF your 2020 filing status is... deduction is... changes in your income or family size to your

Marketplace. See Form 8962 and its Instructions for more

Married filing jointlyor information.

Qualifying widow(er) $24,800

Head of household $18,650 How To Figure Your Estimated Tax

Single or Married filingseparately $12,400 You will need:

• The 2020 Estimated TaxWorksheet,

• The Instructions for the 2020 Estimated TaxWorksheet,

However, if you can be claimed as a dependent on • The 2020 Tax Rate Schedules,and

another person's 2020 return, your standard deductionis • Your 2019 tax return and instructions to use as a guide

the greaterof: to figuring your income, deductions, and credits (but be

• $1,100,or sure to consider the items listed under What's New,

• Your earned income plus $350 (up to the standard earlier).

deduction amount). Matching estimated tax payments to income. If you

Your standard deduction is increased by the following receive your income unevenly throughout the year (for

amount if, at the end of 2020, you are: example, because you operate your business on a

• An unmarried individual (single or head of household) seasonal basis or you have a large capital gain late in the

and are: year), you may be able to lower or eliminate the amount of

your required estimated tax payment for one or more

65 or older or blind . . . . . . . . . . . . . . . . . . . . . . . . $1,650 periods by using the annualized income installment

65 or older and blind . . . . . . . . . . . . . . . . . . . . . . . $3,300 method. See chapter 2 of Pub. 505 for details.

Changing your estimated tax. To amend or correct

your estimated tax, see How To Amend Estimated Tax

•A married individual (filing jointly or separately) or a Payments, later.

qualifying widow(er) andare: You can’t make joint estimated tax payments if

65 or older or blind . . . . . . . . . . . . . . . . . . . . . . . . $1,300 ! you or your spouse is a nonresident alien, you are

65 or older and blind . . . . . . . . . . . . . . . . . . . . . . . $2,600 CAUT ION separated under a decree of divorce or separate

Both spouses 65 or older . . . . . . . . . . . . . . . . . . . . $2,600* maintenance, or you and your spouse have different tax

Both spouses 65 or older and blind . . . . . . . . . . . . . . $5,200* years.

*Only if married filing jointly. If married filing separately, these

amounts do not apply. Additionally, individuals who are in registereddomestic

partnerships, civil unions, or other similar formal

relationships that aren’t marriages under state law cannot

Your standard deduction is zero if (a) your spouse

! itemizes on a separate return, or (b) you were a make joint estimated tax payments. These individualscan

take credit only for the estimated tax payments that he or

CAUT ION dual-status alien and you do not elect to be taxed she made.

as a resident alien for2020.

Payment Due Dates

Social security tax. For 2020, the maximum amount of You can pay all of your estimated tax by April 15, 2020, or

earned income (wages and net earningsfrom in four equal amounts by the dates shown below.

self-employment) subject to the social security tax is

$137,700. 1st payment . . . . . . . . . . . . . . . . . April 15,2020

Adoption credit or exclusion. For 2020, the maximum 2nd payment . . . . . . . . . . . . . . . . June 15,2020

adoption credit or exclusion for employer-provided 3rd payment . . . . . . . . . . . . . . . . . Sept. 15,2020

adoption benefits has increased to $14,300 In order to 4th payment . . . . . . . . . . . . . . . . . Jan. 15,2021*

claim either the credit or exclusion, your modified adjusted * You don’t have to make the payment due January 15,

gross income must be less than$254,520. 2021, if you file your 2020 tax return by February 1, 2021,

Reminders and pay the entire balance due with your return.

Individual taxpayer identification number (ITIN) re-

newal. If you were assigned an ITIN before January 1, If you mail your payment and it is postmarked by the

2013, or if you have an ITIN that you haven’t included on a due date, the date of the U.S. postmark is considered the

tax return in the last 3 consecutive years, you may need to date of payment. If your payments are late or you didn’t

pay enough, you may be charged a penalty for

-2- Form 1040-ES (2020)