Page 86 - Supplement to 2022 Income Tax

P. 86

Page 23 of 26

11:14 - 16-Dec-2021

Fileid: … -tax-table/2021/a/xml/cycle02/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

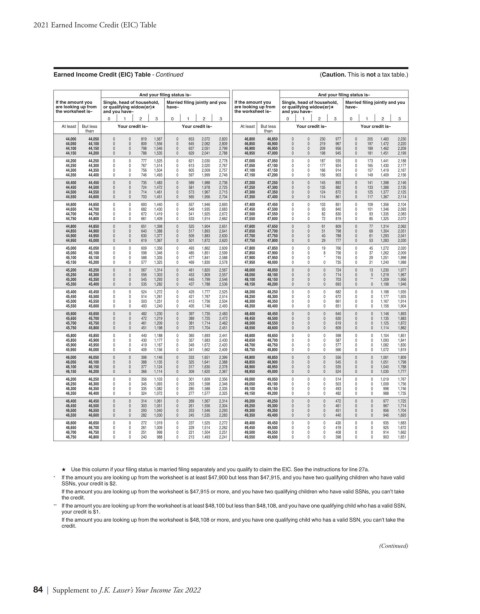

2021 Earned Income Credit (EIC) Table

Earned Income Credit (EIC) Table - Continued (Caution. This is not a tax table.)

And your filing status is– And your filing status is–

If the amount you Single, head of household, Married filing jointly and you If the amount you Single, head of household, Married filing jointly and you

are looking up from or qualifying widow(er)★ have– are looking up from or qualifying widow(er)★ have–

the worksheet is– and you have– the worksheet is– and you have–

0 1 2 3 0 1 2 3 0 1 2 3 0 1 2 3

At least But less Your credit is– Your credit is– At least But less Your credit is– Your credit is–

than than

44,000 44,050 0 0 819 1,567 0 653 2,072 2,820 46,800 46,850 0 0 230 977 0 205 1,483 2,230

44,050 44,100 0 0 809 1,556 0 645 2,062 2,809 46,850 46,900 0 0 219 967 0 197 1,472 2,220

44,100 44,150 0 0 798 1,546 0 637 2,051 2,799 46,900 46,950 0 0 209 956 0 189 1,462 2,209

44,150 44,200 0 0 788 1,535 0 629 2,041 2,788 46,950 47,000 0 0 198 945 0 181 1,451 2,199

44,200 44,250 0 0 777 1,525 0 621 2,030 2,778 47,000 47,050 0 0 187 935 0 173 1,441 2,188

44,250 44,300 0 0 767 1,514 0 613 2,020 2,767 47,050 47,100 0 0 177 924 0 165 1,430 2,177

44,300 44,350 0 0 756 1,504 0 605 2,009 2,757 47,100 47,150 0 0 166 914 0 157 1,419 2,167

44,350 44,400 0 0 746 1,493 0 597 1,999 2,746 47,150 47,200 0 0 156 903 0 149 1,409 2,156

44,400 44,450 0 0 735 1,483 0 589 1,988 2,736 47,200 47,250 0 0 145 893 0 141 1,398 2,146

44,450 44,500 0 0 724 1,472 0 581 1,978 2,725 47,250 47,300 0 0 135 882 0 133 1,388 2,135

44,500 44,550 0 0 714 1,461 0 573 1,967 2,715 47,300 47,350 0 0 124 872 0 125 1,377 2,125

44,550 44,600 0 0 703 1,451 0 565 1,956 2,704 47,350 47,400 0 0 114 861 0 117 1,367 2,114

44,600 44,650 0 0 693 1,440 0 557 1,946 2,693 47,400 47,450 0 0 103 851 0 109 1,356 2,104

44,650 44,700 0 0 682 1,430 0 549 1,935 2,683 47,450 47,500 0 0 93 840 0 101 1,346 2,093

44,700 44,750 0 0 672 1,419 0 541 1,925 2,672 47,500 47,550 0 0 82 830 0 93 1,335 2,083

44,750 44,800 0 0 661 1,409 0 533 1,914 2,662 47,550 47,600 0 0 72 819 0 85 1,325 2,072

44,800 44,850 0 0 651 1,398 0 525 1,904 2,651 47,600 47,650 0 0 61 809 0 77 1,314 2,062

44,850 44,900 0 0 640 1,388 0 517 1,893 2,641 47,650 47,700 0 0 51 798 0 69 1,304 2,051

44,900 44,950 0 0 630 1,377 0 509 1,883 2,630 47,700 47,750 0 0 40 788 0 61 1,293 2,041

44,950 45,000 0 0 619 1,367 0 501 1,872 2,620 47,750 47,800 0 0 29 777 0 53 1,283 2,030

45,000 45,050 0 0 609 1,356 0 493 1,862 2,609 47,800 47,850 0 0 19 766 0 45 1,272 2,020

45,050 45,100 0 0 598 1,346 0 485 1,851 2,599 47,850 47,900 0 0 8 756 0 37 1,262 2,009

45,100 45,150 0 0 588 1,335 0 477 1,841 2,588 47,900 47,950 0 0 * 745 0 29 1,251 1,998

45,150 45,200 0 0 577 1,325 0 469 1,830 2,578 47,950 48,000 0 0 0 735 0 21 1,240 1,988

45,200 45,250 0 0 567 1,314 0 461 1,820 2,567 48,000 48,050 0 0 0 724 0 13 1,230 1,977

45,250 45,300 0 0 556 1,303 0 453 1,809 2,557 48,050 48,100 0 0 0 714 0 5 1,219 1,967

45,300 45,350 0 0 545 1,293 0 445 1,799 2,546 48,100 48,150 0 0 0 703 0 ** 1,209 1,956

45,350 45,400 0 0 535 1,282 0 437 1,788 2,536 48,150 48,200 0 0 0 693 0 0 1,198 1,946

45,400 45,450 0 0 524 1,272 0 429 1,777 2,525 48,200 48,250 0 0 0 682 0 0 1,188 1,935

45,450 45,500 0 0 514 1,261 0 421 1,767 2,514 48,250 48,300 0 0 0 672 0 0 1,177 1,925

45,500 45,550 0 0 503 1,251 0 413 1,756 2,504 48,300 48,350 0 0 0 661 0 0 1,167 1,914

45,550 45,600 0 0 493 1,240 0 405 1,746 2,493 48,350 48,400 0 0 0 651 0 0 1,156 1,904

45,600 45,650 0 0 482 1,230 0 397 1,735 2,483 48,400 48,450 0 0 0 640 0 0 1,146 1,893

45,650 45,700 0 0 472 1,219 0 389 1,725 2,472 48,450 48,500 0 0 0 630 0 0 1,135 1,883

45,700 45,750 0 0 461 1,209 0 381 1,714 2,462 48,500 48,550 0 0 0 619 0 0 1,125 1,872

45,750 45,800 0 0 451 1,198 0 373 1,704 2,451 48,550 48,600 0 0 0 609 0 0 1,114 1,862

45,800 45,850 0 0 440 1,188 0 365 1,693 2,441 48,600 48,650 0 0 0 598 0 0 1,104 1,851

45,850 45,900 0 0 430 1,177 0 357 1,683 2,430 48,650 48,700 0 0 0 587 0 0 1,093 1,841

45,900 45,950 0 0 419 1,167 0 349 1,672 2,420 48,700 48,750 0 0 0 577 0 0 1,082 1,830

45,950 46,000 0 0 409 1,156 0 341 1,662 2,409 48,750 48,800 0 0 0 566 0 0 1,072 1,819

46,000 46,050 0 0 398 1,146 0 333 1,651 2,399 48,800 48,850 0 0 0 556 0 0 1,061 1,809

46,050 46,100 0 0 388 1,135 0 325 1,641 2,388 48,850 48,900 0 0 0 545 0 0 1,051 1,798

46,100 46,150 0 0 377 1,124 0 317 1,630 2,378 48,900 48,950 0 0 0 535 0 0 1,040 1,788

46,150 46,200 0 0 366 1,114 0 309 1,620 2,367 48,950 49,000 0 0 0 524 0 0 1,030 1,777

46,200 46,250 0 0 356 1,103 0 301 1,609 2,356 49,000 49,050 0 0 0 514 0 0 1,019 1,767

46,250 46,300 0 0 345 1,093 0 293 1,598 2,346 49,050 49,100 0 0 0 503 0 0 1,009 1,756

46,300 46,350 0 0 335 1,082 0 285 1,588 2,335 49,100 49,150 0 0 0 493 0 0 998 1,746

46,350 46,400 0 0 324 1,072 0 277 1,577 2,325 49,150 49,200 0 0 0 482 0 0 988 1,735

46,400 46,450 0 0 314 1,061 0 269 1,567 2,314 49,200 49,250 0 0 0 472 0 0 977 1,725

46,450 46,500 0 0 303 1,051 0 261 1,556 2,304 49,250 49,300 0 0 0 461 0 0 967 1,714

46,500 46,550 0 0 293 1,040 0 253 1,546 2,293 49,300 49,350 0 0 0 451 0 0 956 1,704

46,550 46,600 0 0 282 1,030 0 245 1,535 2,283 49,350 49,400 0 0 0 440 0 0 946 1,693

46,600 46,650 0 0 272 1,019 0 237 1,525 2,272 49,400 49,450 0 0 0 430 0 0 935 1,683

46,650 46,700 0 0 261 1,009 0 229 1,514 2,262 49,450 49,500 0 0 0 419 0 0 925 1,672

46,700 46,750 0 0 251 998 0 221 1,504 2,251 49,500 49,550 0 0 0 408 0 0 914 1,662

46,750 46,800 0 0 240 988 0 213 1,493 2,241 49,550 49,600 0 0 0 398 0 0 903 1,651

★ Use this column if your filing status is married filing separately and you qualify to claim the EIC. See the instructions for line 27a.

* If the amount you are looking up from the worksheet is at least $47,900 but less than $47,915, and you have two qualifying children who have valid

SSNs, your credit is $2.

If the amount you are looking up from the worksheet is $47,915 or more, and you have two qualifying children who have valid SSNs, you can’t take

the credit.

** If the amount you are looking up from the worksheet is at least $48,100 but less than $48,108, and you have one qualifying child who has a valid SSN,

your credit is $1.

If the amount you are looking up from the worksheet is $48,108 or more, and you have one qualifying child who has a valid SSN, you can’t take the

credit.

(Continued)

84 | Supplement to J.K. Lasser’s Your Income Tax 2022